All сrypto-friendly neobanks: 8 ICO-backed new players

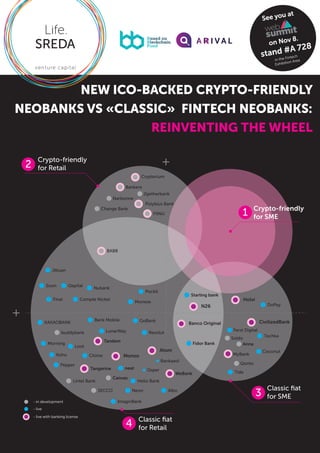

- 1. NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL - in development Anna MyBank Qonto Soldo Ferst Digital Fidor Bank BABB 2getherbank Change Bank Polybius Bank Narbonne FIINU Bankera - live Nubank Loot Koho Pepper Morning Lintel Bank Chime buddybank LunarWay Starling bank neat Canvas Osper Bankaaol WeBank Bank Mobile Compte Nickel DoPay Coconut Final ImaginBank Pockit QapitalSoon Jibuan GoBank AlboNeon Hello Bank Monese Tandem KAKAOBANK Revolut Tide SECCO Tochka Tangerine Crypterium - live with banking license Сrypto-friendly for Retail2 3 4 Classic fiat for Retail N26 Banco Original Monzo Atom Holvi CivilizedBank Classic fiat for SME 1 Сrypto-friendly for SME on Nov 8. stand #A 728 See you at in the Fintech Exhibition Area

- 2. 02 NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL The overview covers 8 crypto-friendly neobanks (2 have already held ICOs, 6 are in the process). They have already raised more than $45 million in cash, and are going to raise about $150 million in aggre- gate. This is about half of the investment attracted in 2016 by “traditional” fintech neobanks, which are higher in number and at a later growth stage! None has gone live - at best, they have implemented a registration module for the future neobank (digital KYC). But even these solutions in the field of blockchain-based digital KYC, judging by the information available, have not been accredited by the central banks or data protection authorities. Meaning that these startups just have it. All are going to serve retail customers – no one is focusing on small and medium business. Whereas in the context of major problems with traditional banks and the existing (not in the future but current) needs for crypto-friendly neobanks, it is the SMEs that are now the most mature target audience: about 500 startups that have already held ICOs (raising over $3 billion which they can’t freely use), crypto-ex- changes themselves, crypto-payment startups, and other community members. Moreover, these SMEs are now bringing greater number of retail customers (their employees, partners and customers) than those predicted in the future by new crypto-friendly neobanks. They are all being established by those who have launched startups before (in some cases fintech startups, but not Class A names), but not banking startups (lacking the experience of communicating with the regulator), neobankschallenger banks. For example, one of the startups had successfully raised money through the ICO, but when they have applied for a license, they have discovered that the regulator was not ready to accept phiath in the bank's capital after the conversion of the crypt raised from the ICO. Considering that almost all of them are going to apply for their own licenses, but none of them have ever done it before, the question arises: there is no doubt that they know how to make cool applications, but do they have enough experience to launch and run a regulated bank? One crypto-friendly bank has made a pretty strange move claiming: we accept crypto to establish a crypto-friendly bank, but "in the beginning we will not work with crypt, in order to obtain a license first." It sounds like "we are opening a gay-friendly bar, but we won’t serve gays for the time being, and, just to be on the safe side, we will participate in gay-bashing because the society requires such behavior." Am I wrong? They all reincarnate “card + app to manage your account” – exactly what has been done a long time ago by the previous and current generations of "traditional" fintech neobanks. That is, instead of taking into account their best practices and adding blockchain / crypto component - they are really reinventing the wheel. “I want to give rise to a new style of verses but I would like to start with reinvention of the English language”. If you are a blockchain expert who is well aware of the current needs of the crypto world, shouldn’t you add your knowledge and functionality (and licenses) to existing neobanks, actively building partnerships with them rather than cannibalize the immature market? The Bubble generation isn’t accepted by traditional banks (even by fintech-neobanks). Bitcoin’s capitaliza- tion is around $100 billion, ether’s capitalization is around $30 billion, the total funds raised through ICOs – more than $3 billion. No one is waiting for you. Banks have "little or no appetite" to get involved with bitcoin and cryptocurrencies due to fears of a bubble and illicit activity associated with it, the chief executive of Credit Suisse said. The chief financial officer of ING also weighed in on cryptocurrency worries, saying that, although digital assets are an effective means of exchange, the bank was not advising clients to in invest in them. Almost all major banks refuse to accept money after the conversion of the cryptocurrency. Let's call things by their own names - traditional banks hate the crypto. But this hatred is stemming from the lack of understand- ing, fear of uncertainty and laziness rather than anger. The money that bank receives after the conversion of the cryptocurrency goes through compliance depart- ment where forty-fifty year old “experienced” employees simply do not understand what it is and where it came from. And here is the most stupid thing: if they spend time to sort out the issue, nobody will praise them for that (therefore they lack motivation), but if they make a mistake, they will be fired. If you convert crypto into fiat and transfer to your bank account less than $50,000, most likely, everything will go smoothly, and you will tell the market that there are no problems and everything works without failures. If you convert from $100K to $300K, the situation is 5050. But if more than $500K, you will definitely have to talk to your bank's compliance. KYC, AML, source of funds… It would even be good that they ask all these questions if they were more tech-savvy (quick and convenient), and if they really wanted to figure it out. But no one wants to sort out your issues; therefore, you get your "account freeze" and "notification of the need to close within 30 days." The Problem: Making digital money tangible

- 3. 03 Why does bank compliance is not willing to understand your issues? First, they already have a large and understand- able business (with which they are familiar), and they are not interested in a new and small (albeit fast-growing) business because its profitability is still small, the risk of losing the current big business is big, and there are many issues they will have to deal with. Second, imagine a specialist in compliance. He/she is 40/50 years old, not highly paid, without any career perspectives. Their mindset is built on the past (instead of the future) and their decisions are conditioned "how to avoid something bad to happen” (instead of "how to help something good to grow easier and more convenient"). They see a lot of transactions daily and finally they see some odd transaction after the conver- sion of the crypt, and … they block it. Why? Not because they are bad people. Simply because they don’t know anything about blockchain, cryptocurrencies and ICO - and in their world "everything that is odd is forbidden". They could even address the matter and the client, but it would take too much time and no one would give them a premi- um for this. But if they make a mistake, they will be fired. Therefore, they send a page or two of dreary questions, and then simply block the account. Are there any "workarounds"?? For sure. In return to one or two pages of questions provide ten to twenty pages of meticulous and detailed answers, thus, “starving the bank out.” However, you need substantial capital for this purpose as you will have to spend money on your back office (lawyers and accountants) in order to collect and accurately store all papers, electronic statements and screenshots of all transactions on mining, receiving, buying and selling of the cryptocurrency; to be able to quickly reply with exhaustive explanations (with schemes and conclusions) about blockchain, cryptocurrencies and ICO; describe how you and your contractors underwent KYC, AML, source of funds procedures; provide full review and conclusion on your partner exchanges. You should better hire a large audit company (such as Deloitte or E&Y) $30-50K, which regulatory verifies what kind of business you do, who you cooperate with and how, where your crypto comes from and how you spend fiat money. You will also need to come up with different purposes of payments from your bank because the "receiving bank" will have questions about the origin of funds, and regular similar transactions with the same justifications will raise questions. Alternatively, you can find some shitty bank in a third world country that will not ask you questions. But in practice the questions will not disappear anywhere and will arise each time you make a payment outside your shitty bank. Let’s assume you have found a shitty bank that is friendly to this type of operations, or have armed yourself with an army of lawyers / accountants / auditors and defeated your clear and large traditional bank. The problems will still be there. If you make transactions in US dollars (and most transactions are sooner or later transferred to dollars at some stage), then you face the "problem of correspondent banks" in the SWIFT system. Your bank should have a correspondent bank in the United States, so that its transactions are conducted around the world through such "superfluous intermediaries". If suddenly your bank "gets on the radar" (will raise questions) of the correspondent bank (and sooner or later, especially with the growth of such transactions, questions arise), then your friendly bank will get to know who it should (not) be friends with. And this is the point when you need to make your choice whether you want to be as inconspicuous as possible in order not to attract attention, and be constantly hiding and avoiding questions. Or you have legally earned your money and want to build new services and a new economy, and do not want to waste time and resources on any political and bureaucratic nonsense? Why the existing cryptocurrency wallets and cards can’t solve this problem? Since these are half-hearted solutions (it's like gluing more and more plasters on the arm affected by gangrene). You depend on your partner bank. And if you reach some large amounts within its cash flows (in fact the business strategy of such partner banks that agree to such an additional risk is to "drown" your transactions in their core business so that they are not noticed, and receive additional income for the risk), the risks that this bank will be approached by senior bankers (regulators and correspondent banks) and asked to stop working with you are not eliminated but simply deferred to a later date. Check the spending limits for these kinds of cards - though it's great that such cards do exist, - but the limits allow you to painlessly buy coffee and t-shirts, while such limits will not work for larger purchases or full-fledged business. They work only for retail customers. What shall SMEs or freelance entrepreneurs do? BABB Yes 2016Plan $50 mn (ICO)UK Everyone is a bank Retail Polybius Bank Yes 2017$30 mn (ICO)Estonia Regulated bank for the digital generation Retail Fiinu Yes 2017Plan $75 mn (ICO)UK Blockchain-friendly British bank Retail Bankera Yes 2017Plan $30 mn (ICO)Lithuania Digital bank for the blockchain era Retail 1 2 3 4 5 6 7 Crypto-friendly neobanks NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL Name Plan to apply for a license Funding FoundedCountry Motto/Idea Primary focus Change Bank 2016$15 mn (ICO)Estonia The future of finance Retail No Narbonne 2017Plan $10 mn (ICO)Switzerland Bank for crypto miners Retail No 2getherbank 2017Plan ICOSpain The first collaborative bank Retail No YesCrypterium 2017Plan ICOEstonia The JP Morgan of Cryptobanks Retail 8 Analysis provided by:

- 4. 04 The growth in digital banking is showing no signs of slowing down. Convenience, speed and security aren’t just extra benefits in consumers’ minds anymore. As a rule, traditional bank institutions struggle to build a loyal customer base, while the newly emerging digital-only banks, like Monzo or Tandem, have all the attributes of a strong brand and can keep customers both happy and engaged with their product. There’s no doubt that mobile banking is one of the most fundamental parts of digital banking. In the future, we’ll see even more payment solutions that take advantage of the Internet of Things and consumers’ state of connect- edness. Has the future of digital banking already begun? Several fintech experts argue that what we see today is not digital banking but simply digitized banking. Hundreds year old financial products are being adapted to the digital era and distributed via smartphones and the Internet. Many believe that the real innovation will sprout once the legacy banks and fintech startups move away from modernizing the digital experience and plunge themselves into launching new digital capabilities. One direction that is shaping up to be an extraordinary one is blockchain banking. It’s a much faster, more efficient and less prone to error process than the traditional automatic clearinghouse (ACH) banking, which can save money and time for banks and make payments almost instantaneous for consumers. Smart contracts allow consumers to exchange money, shares, property or anything of value in a secure, conflict-free way without anyone in the middle to take a cut. Thanks to the transparency of smart contracts, buyers can easily check merchants’ reviews and previous ratings before buying as well as rate them themselves after receiving the item. The rise of cryptocurrencies, or simply digital money, has created a demand for a blockchain-based bank. It wouldn’t be outrageous to suggest that most of the future banks will be digital banks with tradition- al banking services, supporting both crypto and regular currencies. It’s difficult to gauge what lies ahead, mostly due to yet untapped potential of the blockchain technology. But with the legacy banks jumping on the trend and new blockchain-based startups exploring innovative use cases of decentralized financial solutions, we can expect the future of digital banking to unfold in many unexpect- ed ways. Once we move away from digitizing traditional banking services to inventing digital banking services that suit the blockchain era, we will experience increased accessibility and trust, cheaper and faster services and a significantly more automated banking industry. - in development Anna MyBank Qonto Soldo Ferst Digital Fidor Bank BABB 2getherbank Change Bank Polybius Bank Narbonne FIINU Bankera - live Nubank Loot Koho Pepper Morning Lintel Bank Chime buddybank LunarWay Starling bank neat Canvas Osper Bankaaol WeBank Bank Mobile Compte Nickel DoPay Coconut Final ImaginBank Pockit QapitalSoon Jibuan GoBank AlboNeon Hello Bank Monese Tandem KAKAOBANK Revolut Tide SECCO Tochka Tangerine Crypterium - live with banking license Сrypto-friendly for Retail Overview of neobanks’ universe 2 1 3 4 Classic fiat for Retail N26 Banco Original Monzo Atom Holvi CivilizedBank Сrypto-friendly for SME Classic fiat for SME NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL Analysis provided by:

- 5. Change was founded in early 2016 in Singapore. Shortly after, angel investors backed the proposition with over $200k in early investment. Since the beginning Change CEO vision was to combine innovative companies in investment, e- wallets, remittance, credit and insurance to create a global fintech bank. Change aimed at simplify- ing banking in Southeast Asia. The team focus all efforts in creating a simpler and more innovative financial proposition, making use of blockchain technology to link independent high-performing fintech companies around the globe. To accomplish this goal, it has launched an ICO campaign, which ended on October 16 and has raised over $15 mn. Change mobile application starts with the e-KYC platform. It can on-board users from anywhere in the world, in record-time and requesting no more than what is needed automatically validating the users’ transactions with other third-party service providers through Tokenised KYC Information Sharing. The quest towards finance without borders starts here, designing a modern bank that is global from day one. Launching in December 2017 Change's crypto wallet with simple sign-up with minimal information required to store & send cryptocurrencies is being tested by beta testers. Change’s Wallet facilitates the storage of all major cryptocurrencies, easy management of crypto portfolios, simple transfers of funds between peers, and a multitude of other functionalities. 05 CHANGE BANK NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 6. Change’s crypto wallet is secured by applying the highest industry standards. Change works together with a leading wallet security provider in the industry to ensure the safety of funds. The funds are also secured by a combination of hot and cold storage solutions, which provides further security. The ID of the multi-asset wallet is user's e-mail address and/or phone number. User registration automatically creates a blockchain wallet. Access to your wallet is locked by a 6-digit pin-code and any transfers out from your wallet is also secured by a 2 Factor Authentication (2FA) to provide an additional layer of security. Every crypto investor faces the same problem: opportu- nities to exchange digital coins for goods and services in our everyday lives are very limited. Buying with crypto- currencies should be as easy as buying with dollars, euros, or yen. Change Card is a card that intends to solve this issue, allowing users to spend their cryptocur- rencies in millions of online and offline locations worldwide. Cryptocurrencies held within the Change wallet and will only be converted into fiat currencies in real time at the point of payment transaction. With cryptocurrency spending card Change brings cryptocur- rencies to offline use. The first 500 cards (cards are not exist yet) are given to the first token sale contributors. In addition, card holders will be earning rewards by paying with Change Tokens. Change issue cards using industry leader in crypto payments processing. The issuer is a principal member of leading payment gateways such as Visa and Master- card in Europe and has strong security protocols, including real-time updates to electronic verification solutions & fraud. Change’s card systems allow for industry leading dynamic CVV functionality that gener- ates a unique CVV for every transaction. Change Card holders can use the cryptos they stored on their Change wallets to pay for services and products at all Mastercard merchants around the world. The company plans to start sending out the first cards in December 2017, shortly after the launch of Change App. In 2018, Change has set to launch the global financial technology marketplace on blockchain which will aggregate the best ways to invest, insure or lend and will let you use these services from a single interface & wallet. Change vision goes beyond just using cryptocur- rencies for payments. “It is time that you could also use your cryptos to invest in stocks, P2P loans, real-estate or anything else you can imagine. It is time that you could buy travel or car insurance instantly with your Ether or take a loan in bitcoin. Not We just believe in de-central- ized data but also in the power of de-centralized services. Think of Change as an "AppStore" for special- ized financial service companies that outperform your bank, while removing the need to sign up or deposit funds to these services individually. Invest in a diversified stock portfolio or real estate, finance loans, sign travel insurance - all from one interface with complete transparency and zero delay.” "We live in a time where for almost every single service a bank offers, there is a fintech company that utilizes state-of-the-art technology and a lean & mean team to provide a better, faster and cheaper service. This isn't a forecast, this is today," says Kristjan Kangro, CEO of Change. The company focuses on nailing one specific service, be it transfers (Transferwise), payments (Stripe), investing (Smartly) or insurance (Oscar). In order for the marketplace to be regulatory compliant, Change is building a multi-tiered standardized KYC (Know-Your-Customer) utility. Users won't need to present extensive information to simply sign up for the app and get a crypto payment card. However, "to use regulated fintech services, you'll need to verify your identity" says Kangro. Estonia's e-Residency conducts a thorough background check, while also having a very strong potential customer-base to offer services to. The API library will be open to all developers that wish to be part of our financial ecosystem. By opening our data, functionality and services to third-party develop- ers, they can integrate their systems and Change can expand its list of innovative services. 06 CHANGE BANK NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 7. Change marketplace integration allows various KYC information to flow within the Change financial ecosys- tem. This means that one digital identity will be applied across all partners that have integrated. As Change's platform becomes the standard of the industry for shared KYC and easy integration, it will create a network effect to pull more and more fintechs in to the ecosys- tem. This is aimed to create a diverse financial ecosys- tem that collaborates, innovates and thrives. Change has partnered with the e-Residency project by the govern- ment of Estonia, the most advanced digital society in the world and it will be available to every of projected 10 million e-Residents. "Digital Identity is one of the keys to solving financial inclusion so we are delighted that Change is using our secure government-backed digital identities to help solve this issue and develop their business." - Kaspar Korjus, Managing Director of e-Resi- dency. Vision of the all-in-one platform for financial services is not geographically bound by borders. Today’s technol- ogy and regulation allows us to create a de-centralized third-party marketplace that brings you the leading financial technology products. ANYONE can use the most suitable service provided from ANYWHERE. In 18 months, the Change API will be opened to credit and insurance. Change enables the allocation of funds to financial services based in foreign countries, avoiding the bureaucracy of traditional banks, bringing to life the concept of truly borderless finance. Fintech companies benefit from joining the Change Marketplace as they are able to present their products to users of the crypto bank, with no geographical restrictions. Local compa- nies, expanding their user base, reaching millions. The Change Marketplace is self- regulating, meaning that while initial approval is decided by the Change team, a fintech can only remain in the marketplace if it is popular and satisfactory the services will be rated and usage rates published. Users will be rewarded for using the Change Card and other third party services on the platform - online or offline - receiving part of the transaction back in the form of Change Tokens. Any time a user makes an online or offline payment using Change Card, he or she will receive a 0.05% rebate in the form of Change Token. The rebate will double if the user pays using Change Token. This incentive benefits token users and holders, as it ensures that the currency is constantly being traded, making it more desirable and valuable. For example, a user that spends 3000 Change Token on a brand new laptop will receive a rebate of 3 Change Token. Third-Party Service Providers (TPSPs) share 20% of their revenues generated from Change users with Change. This 20% is distributed between Marketplace investors and holders of Change token in a 1:5 ratio. With 16.67% going to marketplace investors and 83.33% being distributed to Change Token holders. The Change has a team of 10: Kristjan Kangro, CEO – Serial entrepreneur. Previously CFO of Expara and CEO of SwingBy. Artur Luhaaar, Partner – Serial entrepreneur. Current CEO of Smartly (Singapore-based robo advisor) and former analyst at an investment firm. Gustav Liblik, Partner – Serial entrepreneur. Current CEO of Catapult, former CEO of Wastes- canner. Edgars Simanovskis, CTO – Also the current CTO of Danabijak. Previously an iOS developer for various companies. Change has a team of advisors, including Roger Crook, ex-CEO of DHL Global Forwarding, Rob Findlay, Founder of Next Money, and Miguel Soriano, Professor at the National University of Singapore. Change has conducted regular meetings with companies across the fintech and cryptocurrency space. 07 CHANGE BANK NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 8. Narbonne will be a fully automatic bank without people and offices. Narbonne - a crypto bank for users and corporations. You will be able to spend your cryptocur- rency around the world, using Narbonne debit cards. It will use extensive experience in the field of online micro-lending, peer to peer lending and traditional bank lending. Narbonne team has experience in creating from the scratch financial institutions in the field of micro-lending in Spain, Germany and Russia. The company’s head office will be in Switzerland. Narbonne Services: For Deposits in crypto-currencies - Narbonne Wallet Safe For any Settlement accounts for business - Narbonne Wallet Enterprise Globally accepted Debit cards Pledged and unsecured loans Technology Implementation will include Application of smart bots with AI elements; Voice Control of online banking system; Face recognition system determining age and gender of person; A system made to handle online applications of lending and deposits. Tech developed by Narbonne team has already become quite popular in the crypto community and is being used by over 40 fiat money organizations. These include banks and other famous micro-lending companies that are based all around the globe. Overall it will have debit cards, automated lending, marketplace, private accounts safe wallets, secured currency, deposit derivatives and smart contracts. Narbonne will use the system of initial coin financing for the Narbonne project. For this purpose, Narbonne will issue a token: the Narbonne Credit Coin (NCC). The token is acceptable by all Narbonne services. NCC token can be used to make loan repayments to Narbonne. There will be two groups to which tokens will be distributed namely, Narbonne's debtors and partner's lending institutions whose borrowers will use NCC. A total of 1000 million of tokens will be issued for this purpose. The token functionality issued initially is of ERC20 standard. 08 NARBONNE NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 9. This year, NCC will be used by most of the lending organizations dealing in cryptocurrencies. Over the next year, the demand for NCC on exchanges can outgrow its original volume by a factor of 25, which would lead to an exponential growth of its value. From this point onwards, the currency will be founded on the loans made by Narbonne and loans that users have taken from other banks around the world. The following steps will be taken to create credit support for NCC: (1) Narbonne issues Narbonne Credit Coin (NCC). As a result of the ICO, a proportion of the tokens (35%) will be distributed among banks and lending institutions around the world. (2) As a condition for receiving these shares, these banks will have to agree to accept loan repayments in NCC. Why is Narbonne a crypto bank project? Banks have long existed as centralized organizations for saving cash. Bitcoin destroys cash. Therefore, we have preserved the property of an organized bank: the technology for lending. We have re-invented the approach of banks of the past to create a decentralized crypto bank with a marketplace that will now operate globally without restrictions for all people. And our automated systems will help in this. It can be said that some innovations spur other innova- tions, accelerating the emergence of newer and more advanced technologies. Innovations now are emerging so fast that that they become a part of our life almost without us noticing, because more agile companies are all trying to inspire customers to use their services. Narbonne Team: The founder and CEO of Narbonne is Maxim Elsner. He founded AFCOM.TECH, currently one of Europe's leading companies specializing in software development for microfinance and banking. He won the Microsoft Research Faculty Fellowship Award. The Chief Operating Officer of Narbonne is Garcia Y. Maria. She has experience of work in Unicredit Bank. She Has a PhD Finance. The Chief Technology officer of Narbonne is Vasily Nesterov. He has experience of leading teams over 15 years in various technological projects. He also worked in Microsoft Azure. The developer team of Narbonne has developed software for 40 banks and microlending compa- nies. 09 NARBONNE NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 10. BABB (or Bank Account Based Blockchain) is the World Bank for the Micro-Economy, a decentralized banking platform that leverages blockchain, AI, and biometrics technologies to offer anyone in the world access to a UK bank account for peer-to-peer financial services. In June 2016 BABB raised seed funding and was accepted into the Level39 Accelerator Space in Canary Wharf. As of October 2017 the company plans to do an ICO planning to raise up to $50 mln. “I believe BABB’s plan to bring banking services to everyone, through the blockchain and the latest mobile technology, will both provide new features not seen in the high street banks and include many who have been excluded from the traditional financial system,” said Guido Branca, CEO of BABB. The company doesn’t consider itself as a challenger bank but rather as an enabler helping existing banks and financial institu- tions to innovate. The platform will allow users to “leverage their social connectivity and their money in new ways” with more control and greater transparency. It will connect users to each other, allowing peer-to-peer transactions over the network. Beneficiaries and senders will be connect- ed directly, without resorting to unnecessary middlemen or middle-layers of technologies. In March BABB announced that it has entered into an agreement with Contis Group Ltd to use their white-la- bel license and Contis’ banking services infrastructure to provide UK bank accounts, transfer and card payment services. The first stage of this relationship will cover integrating BABB’s core blockchain banking platform with Contis’ banking services and payments infrastruc- ture. BABB plans to soft launch its blockchain-based banking platform in 2017. The company is currently applying for a full banking license and is seeking to enter the UK’s Financial Conduct Authority (FCA) sandbox. The compa- ny is building a banking platform based on a “permis- sioned” ethereum blockchain implementation of a distributed ledger using smart contracts technology. The platform is based on a decentralized information model to minimize costs while maximizing data fidelity and security. Using biometrics to facilitate client onboarding and transaction authentication, with big data analytics to optimize match-making and control risk and with AI-based customer self-service intended to provide banking services for all. 10 BABB NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 11. “This is why we say: “Everyone is a Bank” irrespective of their income level”. Every user downloads the app, provides a selfie and a voice print, and gets a UK based account upon activation. With the BABB app, you can open a UK bank account from anywhere in the world by taking a selfie and saying a passphrase. Once you’ve entered the BABB ecosystem, you become your own bank. Anyone with a smartphone and an internet connection can participate in BABB’s global market- place. “You can send money to any other BABB user anywhere in the world instantly and for almost no charge. Simply choose the amount you want to send and the person you want to send it to, and confirm the transfer using your digital identity.” As a bank, you can exchange currencies directly without any middlemen. It’s cheaper, faster and easier than doing it any other way. A multi-sided platform, BABB is designed to provide banking and other financial services to individuals and small businesses. Customer data will be encrypted and stored security on the blockchain where the permissions for who can access or use that will be entirely controlled directly by the customer. The Black Card bridges the divide between the digital world and the physical world. It is a secure payment card that links directly with your BABB bank account via a secure QR code or NFC tag. It allows both a debit-like functionality, and can also be issued as a pre-paid card for your friends and family. Retailers can accept payment using the BABB card by simply downloading the BABB app and scanning the QR code or via NFC. Payment is made instantly into the retailer's bank account and the funds can be used immediately. With the Black Card you are able to spend your BAX in shops and peer-to-peer. Payments can be made instantaneously, anywhere in the world or for online shopping. No personal information is stored on the card itself. If you lose your card, you can easily disconnect it from your bank account, preventing anyone else from using it – all from your smartphone. If you find the card again, simply scan the QR code via your BABB app and it reconnects to your BABB bank account. New cards will be available very cheaply in shops and from major online retailers with next day delivery. Alternatively, pick up a spare from a friend, scan the QR code with your BABB app and you are good to go. Social KYC: “Vouch for anyone you know, and give them access to a UK bank account using only a smartphone. BABB’s platform promotes trust. Therefore, on our network, other users’ trust is enough to open an account with core functionalities. Our innovative ‘Social KYC’ process allows anyone who is fully KYC-ed, with validated documentation, to vouch for other users and onboard them to the platform. In this way, we will extend our services to millions of people without requiring them to provide ID documentation. Our Social KYC mechanism will promote exponential growth of our user base. This is particularly useful for onboarding the unbanked in emerging markets, seeing as one of the main barriers they face is lack of documentation. As BABB’s value is proportional to the number of users on the network, there is a strong incentive for early adop- ters to encourage their peers to get on board. Removing barriers to access. To open a UK bank account, the new member simply needs to download the app, take a selfie and say a passphrase. By utilizing biometrics and digital identity technologies, we can remove barriers to access and create a frictionless onboarding process. There is no need for documenta- tion or face-to-face meetings with a bank managers. The whole process will be at your fingertips.” Social KYC is a key part of our strategy to create fully banked communities and promote financial, economic, 11 BABB NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 12. and social integration. It will include those who cannot provide relevant documentation such as low-income employees, refugees, and asylum seekers. People are stronger when they work together, and social KYC will enable communities to become fully connected. It is an Open Platform. Any business can accept support- ed currencies, fully compliant, anywhere in the world. BABB will empower the microeconomy, improving lives and livelihoods and creating new opportunities for individuals and businesses across the world. Businesses and developers can create applications to plug seam- lessly into the BABB platform. From freelancers employed in the gig economy to global corporations, BABB’s borderless integrated payment systems can reduce the cost of doing business. Despite building its banking platform on top of block- chain technology, BABB has decided to stick with fiat currency as opposed to developing a pure digital currency–based banking platform. “Crypto is still a challenge,” BABB CEO Guido Branca told Bitcoin Magazine. “It will play a role, but we need to transition to that new landscape. Stakeholders (central banks, regulators and the banking community) are still evaluat- ing [the use of digital currencies in the financial system]. We think the underlying technologies of blockchain, smart contracts, tokens and distributed ledgers have a role to play in easing this transition but we must walk before we run.” “We are specifically targeting the micro-economy/market while [other mobile banks] are doing more or less the same services (but branchless) as the established high street banks. We believe that the financial market is so huge that many different [mobile banking] models will coexist.” Andrew Downin, innovation director at Filene Research Institute speaking during the 2017 CU Direct DRIVE conference in Las Vegas, said that BABB’s offering is an “intriguing development.” BABB cautious in that it is using a fiat currency [a government-based currency such as dollars, Euro or pounds] as opposed to develop- ing a pure digital currency-based banking platform. Downin said this was a smart move. “We continue to see valuation risk in digital currencies such as bitcoin, and acceptance of these digital-only currencies is still nascent,” he said. The BAX token is the native currency of the BABB platform. Token sale participants can buy and hold this currency and benefit from the value of the platform. The BABB team is a diverse group of visionaries span- ning an exceptionally broad range of experience, knowledge and cultures from across the globe: CEO, Rushd Averroes is founder of BABB, leading a diverse team of industry veterans to make his vision a reality. He is a financial inclusion special- ist and has an MA from University of Greenwich in Microfinance and Financial Inclusion. Before that, he attended the Ecole Polytechnique de Lausanne and was awarded an IT Science Degree in 2006. Rushd has managed a highly successful Authorised Payment Institution (API) in the UK - Wowpaymobi. CTO, Jorge Pereira is an entrepreneur and technologist, with extensive experience in developing technology projects in a variety of areas, for local and global markets. He founded Seegno in 2008, a world-class web application development firm, where he remains as an advisor. In 2013 he joined Uphold, where as CTO he was responsible for the design and architecture of the whole technology stack, as well as UI and UX of its products. Ever since, Jorge has focused intensively on fintech, developing products and technology around Cryptocurrencies, Distributed Ledgers, Regulatory Compliance, KYC/AML, Fraud Prevention, Risk Mitigation, Trading, Hedging, Bank Integrations and other areas related to fintech platforms and applications. COO, Adam Haeems is responsible for the daily operations of BABB. He has a Master of Finance from Cambridge University (Judge Business School) and joins BABB fresh from an accom- plished trading career at Bank of America Merrill Lynch and a $1bn global macro hedge fund (QCM). He is passionate about financial inclusion and improving market efficiency within the microeconomy. 12 BABB NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 13. Polybius Foundation, a financial services company established this year and registered in Estonia, is building a fully digital bank for businesses and individuals and the “first bank in the world to specialize in financial services for cryptocurrency startups and blockchain projects.” In February 2017 Polybius Foundation announced the opening of the Polybius Bank — the first European bank specializing in financial services for companies dealing with cryptocurrencies and blockchain worldwide. Polybius Bank will combine features of modern banking, IoT, Big Data and blockchain-based technologies while also meeting security and UX requirements. Polybius financial services will be fully interconnected with international systems to respond to the transaction needs of our customers worldwide. Polybius Bank will operate on the principles of an Open API, employing reputable innovations and service within the framework of payment and data processing industry. Polybius Bank will offer a traditional selection of financial services such as deposits, credit financing and bank card issuance, but also services especially targeted at blockchain startups and projects such as credits secured by cryptocurrencies as well as the ability to create of investment portfolios based on cryptocurren- cies. Polybius Bank intends to apply for a EU financial institution license. The concept is similar to BABB App Ltd., a London-based startup that’s building a banking platform using Ethereum smart contracts. But according to our data, the European regulator has prohibited Polybius from using funds received from the ICO to fund capital requirements necessary to obtain a banking license. Not clear how the startup is going to deal with the issue. The Digital Pass technology, developed by HashCoins and implemented into Polybius Bank, will serve as an automation and digitalization ecosystem, allowing us to not only integrate single companies, but entire industries enabling access to financial and industrial services in the same Pass, at a click’s hand. Digital Pass is an independ- ent environment as a service, which will serve as a storage for encrypted individual information. The security of access to the information will be enabled by SSL certificates, dynamic PINs and, to some extent, by biometrical data. Polybius Foundation, signed a memorandum of under- standing (MoU) with Ukrainian startup Attic Lab in April, will be using Attic’s OpenBankIT blockchain platform to provide payments. The other startups involved in the digital bank’s foundation include CryptoPay, a crypto- currency payments firm, HashCoins, a developer of blockchain solutions, and AmbiSafe, a developer of Ethereum smart contracts. 13 POLYBIUS NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 14. According to Ivan Turygin, co-founder and chairman of Polybius Foundation, the company has big dreams for its digital bank as it aims “to build the ultimate financial infrastructure, sort of a ‘financial Google.'” By providing the infrastructure for system-to-system communications, Polybius Foundation will act as a Trustee service and will be responsible for the control and execution of compliance-related directives. Designed to comprehend a variety of networks, the infrastructure of Polybius Foundation features a multi-segment decentralized data storage for personal data, cryptographic encryption of all entries and secure mechanisms of identification, authentication and authorization of individuals and companies by means of the interconnected instruments. The data will be driven from all the channels related to services of Polybius Bank, Digital Pass and its trusted entities for further processing and analysis. Due to the sensitive nature of the information and to ensure the scalability in processing capacities, the evaluation of data will be automated by means of applied AI algorithms. Polybius token - Polybius blockchain Share - repre- sents the right to receive a part of company's profit. All token holders are eligible for obtaining dividends according to their stakes. Any number of tokens (100%) sold at the end of ICO have right to receive 20% of company's profits. According to the company bylaws, at the end of a financial year 20% of the company's profit is transferred to an ETH wallet. The ETH is then redistrib- uted to all holders of Polybius Tokens according to smart contract conditions. While starting off as primarily a financial institution, the Polybius project is meant to grow into your daily servicer and companion ecosystem. Among other planned features are scoring and sensitivity systems for credit and insurance businesses, asset and currency trading systems, seed & VC investment tools, eID and Trust services and other features described in this Prospectus. The Polybius ICO ended on 5th July, immediately ranking among the top five largest ICOs of 2017, raising $31 mn with 27,000 participants. ICO proceeds are intended to be spent mainly, but not exclusively on acquisition of licenses, building out the systems, hiring the team and marketing. Polybius Bank will rely on a set of public and private licenses instru- mental to comply with many regulations, existing in the financial field. Among them are the public EMI and banking licenses, the participation in Card Schemes, the creation of regulation-compliant identification mecha- nisms and other technical conditions to meet. Every milestone step is an advancement to a broader set of services at Polybius customers' disposal. During the initial step for a viable Polybius operation, a set of conditions needs to be met. Among the minimal requirements are licenses (small Electronic Money Institution (sEMI) or Payment Institution (P.I.) licenses) and mechanisms to comply with the law and financial regulations, Combating Financing of Terrorism (CFT), etc). At this step, instead of the sEMI license, Polybius, will apply for a license for the Authorized Payment Institution (A.P.I.) for the sake of lowering the initial investment requirement. A.P.I. license is required to store clients’ money and organize payment processes. The time required to acquire the license is 3-9 months. Polybius A.P.I., will be legally considered a non-banking financial institution (NBFI-ND) and will not take deposits until acquisition of the banking license. SWIFT membership is also required as one of the key elements for banking procedures. Joining the SWIFT network enables a bank to receive a Business Identifier Code (BIC), and to be able to communicate with other financial organizations via SWIFT messages for electron- ic money transactions. It may take up to 3 months for the application to pass through. Polybius Payment Institution will adhere to the EPC Rulebooks to use them in the European payment and messaging network for the Euro zone. The EPC Rulebooks define principles of money transfer in Euro according to the European Union Regulatory Frame- work. The time required to join and to operate the EPC Rulebook network is expected to be 6 months. Compli- ance with specific rules, laws and regulations is of utter importance in banking environment. A banking institu- tion is obliged to set and follow high standards of operations in order to protect its stakeholders. Besides that, the reputation of a bank can also be severely damaged by poor processes including KYC and AML/CFT techniques and software. We will use existing tested technologies to comply with the standards and the requirements. P2P loans are a new model in credit systems, which allow organizations to establish a platform that links those looking for loans with those looking for small investments and profit. Such systems are a great way for financial institutions that match the lenders with the borrowers to generate a capital-efficient, credit risk free revenue stream on processing (e.g. platform mainte- nance, customer due diligence, scoring). We see a particular opportunity in cross-border P2P lending while most of today’s platforms are locked into a single jurisdiction. The Polybius project is driven by a number of expert groups of with common vision everyone actively involved in the key strategic decisions, project planning and development. The team is regularly drawing on the expertise of the deep bench of the advisors affiliated with the project. Additional tech and finance profession- als have committed to join the project. The core team includes: Ivan Turygin (Founder and Chairman at Hash- Coins OÜ). Sergei Potapenko (Founder and CEO, HashCoins OÜ). Nikolay Pavlovskiy (Blockchain Engineer and CTO at HashCoins OÜ). Vitali Pavlov (Production Management and Chief Product Officer at HashCoins OÜ). 14 POLYBIUS NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 15. The rise of cryptocurrencies, or simply digital money, has created a demand for a blockchain-based bank. Bankera is a startup that’s catering to that demand. It supports both fiat currencies and cryptocurrencies and provides a good range of services like any traditional bank, including payment processing, debit cards, loans and low-cost investment products. The catch here is that although Bankera acts like a traditional bank, it is crypto first by nature, pioneering innovative services like taking crypto assets as collaterals for loans. Launched in 2017, Bankera is an operating subsidiary of the popular cryptocurrency exchange, e-wallet, debit card and payment processor — SpectroCoin. SpectroCoin team has which developed bank-like infrastructure releasing Bankera to leverage regulatory and IT infrastructure to develop a bank for the blockchain era. Bankera as a proper bank will offer payments, investments, and loan and deposit solutions. Later on, it is planning to develop new types of money, such as inflation linked baskets. Payments including payment accounts with personal IBAN, debit cards, interbank foreign exchange rates and payment processing. All services will support both traditional fiat currencies as well as cryptocurrencies such as bitcoin, Ethereum, DASH, NEM, ERC20 compli- ant tokens and others. It will make Bankera one of the first crypto-friendly regulated banks in the market. In the long term, Bankera will implement innovative solutions such as gross-domestic-product (GDP) linked currencies and the use of exchange traded funds as a substitute for money. The required IT infrastructure to facilitate payment processing and issue personal IBANs or payment cards have already been developed and are available as a minimal viable product (MVP) in the form of Spectro- Coin. Support of full P2P transfers, mobile wallets and the start of membership application of the major payment networks such as card schemes and remit- tance networks will be implemented in wallet. The company plans to apply for a banking license after ICO. This will allow Bankera to offer loans and deposit services to the clients. Loans and deposits will be a key competitive edge as well as core service of Bankera. Current deposits will receive interest just as savings do. All Bankera clients will be able to benefit from higher interest rates due to proprietary information about borrowers' cash flow, as most loans will be given to business clients who use the payment processing solution. 15 BANKERA NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 16. Investments will consist of low-cost investment prod- ucts such as exchange traded funds (ETFs), crypto-funds (a portfolio of various cryptocurrencies and crypto tokens) as well as roboadvisory solutions for wealth management. Eventually, Bankera will offer investment banking services including financing corporate strate- gies of our business clients. Bankera launching an initial coin offering (ICO) to issue Bankera tokens on the public blockchain. After raising 25 million Euros during one of the biggest pre-ICO sales to date, Bankera, a blockchain based banking service, has announced it is going to hold its ICO sale on November 27. The tokens called Bankers (BNK) issued during the pre-ICO and ICO. Each holder of Banker (BNK) tokens will be entitled to a referral commission, paid weekly; this will be constituted of 20% of Bankera and Spectro- Coin net transaction revenue. This will be implemented by taking 20% of Bankera's and SpectroCoin's net revenues and sending them to the smart contract. For example, if net revenues of Bankera for a week are 10,000,000 EUR, 2,000,000 EUR as referral commission will be sent to the smart contract. Bankera will offer businesses instant payment settle- ments using advanced proprietary know-your-client (KYC) and fraud detection solutions to collect informa- tion about the incoming payments and automatically settle transactions which otherwise could take weeks. Advanced technologies will also allow Bankera to estimate clients' economic power and thus offer them a better loan and deposit rates. At this point, Bankera has the necessary regulatory and IT arrangements and has put together a strong team and advisory board, including Lon Wong, president of the NEM.io foundation, as well as Antanas Guoga, a member of the European Parliament, also known as Tony G – a famous poker player. Guoga is actively endorsing blockchain technology and cryptocurrency at the European Parliament and beyond. Bankera’s founding team already owns and operates a successful cryptocurrency exchange, e-wallet, debit card provider and payment processor. The aim of the ICO is not to test a speculative idea, but to provide the capital to enable Bankera as a product to expand its existing services to compete with existing banks as an equal across all areas of operation including payments, lending, currency exchange, and investments. The contribution of SpectroCoin to Bankera will be not only IT and regulatory infrastructure, but also an introduction of Bankera services to 400,000+ existing clients of SpectroCoin and share of a SpectroCoin’s talent pool of 50+ blockchain specialists. Most impor- tantly, SpectroCoin will be entitling Bankera token holders 20% from its net transaction revenue from the first week after start of pre-ICO. Bankera recognizes that cash is still the predominate form of payment and Bankera will be active in the cash market. One issue is that Bankera will not have physical branches like traditional bricks and mortar banks. As such, Bankera has a three-pronged attack to remain competitive in cash. Partnerships with existing providers for cash deposits and withdrawals. Bankera will partner with retail providers who currently distribute cash deposit and withdrawal services. Network of agents. In developing countries where infrastructure to handle deposits and withdrawals is not established (such as South America), Bankera will offer relevant retailers (such as newsagents or gas stations) the ability to be agents for Bankera to handle deposits and withdrawals. Each of these agents will have an account with Bankera to facilitate this. As Bankera will be issuing payment cards, they could be used as an option for withdrawals at most ATMs available globally when cash is needed. Bankera will offer money wallets in 22 fiat currencies initially, covering all the major currencies such as USD, EUR and GBP. In addition, Bankera will also support emerging digital currencies such as bitcoin, Ethereum, DASH, NEM and others ensuring that Bankera will be at the forefront of the emerging cryptocurrency ecosystem. One of the key challenges for fast growing businesses accepting non-cash payments is capital immobilization. Bankera will create short-term finance products to bridge this cash flow gap for businesses. As a payment processor, Bankera will have an advantage over banks because Bankera will collect live information about expected incoming payments. This will facilitate Bankera offering credit for businesses secured against expected future cash flows. Bankera will not only become a regulated European bank, but also will seek to become authorised issuer and acquirer of payment cards and obtain banking licenses in key jurisdictions to avoid dependency on the corre- spondent bank services, which are extremely fragile nowadays as identified by the World Bank when they concluded that correspondent banking relationships (CBRs) are declining1 due to several factors including AML risk or reduction of risk. Having multiple licenses will allow Bankera to offer instant cross-border transactions as well as having access to a low currency exchange rates due to direct access to financial markets in multiple jurisdictions because of having these licenses. Bankera has assembled an expert management team with a diverse range of skills: Vytautas Karalevičius (CEO) is currently completing a PhD in cryptocurrencies at KU Leuven University in Belgium. Prior to that, he received a MPhil degree in Finance from Cambridge University and BA degree in Business Finance from Durham University. He is currently conducting research on the potential of blockchain technology for securities transaction lifecycle for the SWIFT institute. Previously, he has worked at Bloomberg (London office) in management consulting. Mantas Mockevičius (CCO) has more than eight years’ experience in managing operations and compliance for an electronic and digital money exchanges. He holds a bachelor degree in economics and master degree in finance. Justas Dobiliauskas (CTO) has nine years’ experience in developing software for medium and large financial institutions as well as five years’ experience working with blockchain technology and cryptocurrencies. He is an expert in P2P technologies and holds a Masters Degree in Information Systems Security. 16 BANKERA NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 17. Crypterium which is headquartered in Estonia builds a cryptobank focusing on three main services: giving individuals the ability to use cryptocurrencies to make payments in their day-to-day lives, establishing an innovative infrastructure that gives businesses new opportunities for cryptocurrency acquiring (and makes it easy for vendors to receive cryptocurrency payments as fiat money), and cryptolending, which it is attempting to streamline. Doing all this requires a multidisciplinary team that brings in specialists in finance, banking, cryptocurrency, financial IT, strategic development, and investment. The Crypterium goal is to create first full-fledged cryptobank of its kind, which will address everyday tasks associated with the use of money, for example using cryptocurrency, like in an ordinary mobile banking app, to pay for mobile services, utilities, and taxes, to make transfers, pay at a café or restaurant, take out loans, and other services that are currently offered by legacy banks. “In contrast to ordinary banks, Crypterium is regulated not by the ordinary regulatory authorities, but by the blockchain infrastructure. In addition, many banks operate locally; we plan to offer services worldwide. Banks restrict withdrawals and transfers; we have virtually no restrictions. In fact, the differences are much, much greater, but that’s a whole other conversation.” Crypterium’s Early Sale started on October 31, 2017, and will run until November 6, 2017. The Early Sale offers four tiers of bonuses depending on the number of purchased tokens. The next stage of the sale, which will commence on November 7 and will go on until Novem- ber 27, will offer lower bonus amounts. The no-bonus sale will start on November 28, 2017, and end on January 13, 2018. Crypterium managed to attract already an impressive $7.5 million from its supporters. All the funds collected via the ICO will be directed to building a complete vertically integrated service that encompasses the best blockchain technology capabilities to solve the complex issues of using cryptocurrencies in the real world. “$7.5 million in CRPT token early sales gives Crypterium’s business model a firm vote of confidence from the blockchain community,” says Steven Polyak, Managing Director and Crypterium co-founder. “Right now, cryptocurrencies are not the financial instrument of choice for paying for the most routine purchases. The platform we are developing will offer the market a powerful and secure solution through which clients will be able to use cryptocurrency in the same scenarios in which they’re accustomed to using ordinary money,” he concludes. The project advisors, among whom are such renowned blockchain personalities as the TechCrunch co-founder Keith Teare and ICOBox co-founder Mike Raitsyn, are excited about the early results. “The project’s soft cap was set at 500 BTC. We are very pleased that it was reached right in the first day of Crypterium ICO,” says Keith Teare. Teare, a grizzled veteran of the international technology sector, is perhaps most famous as the co-founder of the TechCrunch tech news website, but has a long list of projects under his belt stretching back decades, among them Accelerated Digital Ventures, Minds and Machines Inc., MedCo, just.me, Archimedes Labs, Easynet, and RealNames. The latter two had valuations that hit $1 billion. Steven Polyak, commented on token sale: “Our token will perform two functions. The first will be similar to the ‘gas’ used in Ethereum. In our case it will be used to support and develop Crypterium. There will be a 0.5% charge on each transaction performed on our platform, which will be used to purchase tokens from the exchange that will be burned during the performance of operations. This will ensure stable demand and, accord- ingly, a growth in the value of token. The second function involves the formation of a token fund called the Monthly Cashback Fund, which will receive 30% of our economic benefit obtained from the fee paid by a business for the use of our platform.” Crypterium core team includes: Steven Polyak (Managing Director, Co-founder). Steven is highly experienced investment banker with a focus of interest on capital markets in the USA and Russia. Austin Kimm (IR Director, Co-founder). Financial services CEO, Austin Kimm is an international strategist for established and start-up companies. Gleb Markov (COO, Co-founder). Fintech, banking and cryptocurrency professional with over 10 years of experience in the industry. Vladimir Gorbunov (CCO, Co-founder). Entrepre- neur with more than 10 successful new ventures and a particular focus on simplifying real-world issues through technology. 17 CRYPTERIUM NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 18. Fiinu, a UK-based tech-driven bank, has recently launched a pre-sale, ahead of its full ICO in November. The bank wants to be the UK’s first blockchain-friendly bank to also offer retail banking services and products for those currently under-served by the incumbent banks. Users of crypto-currency will benefit from a single account for both sterling and crypto-currency use, and will be able to drawdown crypto-currencies into sterling (and other currencies) for a fraction of the current market rate. Additionally, customers currently being under-served by the incumbent bank’s archaic credit rating system will finally be able to access services designed to lower the cost of banking and improve the quality of financial products. One of the key parts of Fiinu is its Finnuscore credit rating system. This credit rating system promises to “lend responsibly to consumers and small businesses against crypto-based assets and help their short-term credit needs with overdrafts whilst encouraging financial resiliency.” The company is undertaking positive discussions with regulators whilst applying for a full UK banking license. Upon receiving its banking license (scheduled for the end of 2018) and becoming profitable, investors will receive highly competitive returns on their invest- ments, compared to investing in the shares of incum- bent banks. In addition, Fiinu Coin (FNU) will offer a number of highly beneficial privileges: 33% of retained profit will be distributed to FNU holders every year; FNU can be borrowed against. Once authorized, Fiinu will grant credit in sterling, for up to 75% LTV against FNU, starting with UK-residents; Services will include innovative smart credit products and budgeting tools. Fiinu will use up to 10% of the raised funds as working capital, while the remaining invested funds will be protected in an escrow arrangement until Fiinu receives its banking license. If the banking license application is unsuccessful, all Ether (ETH) in escrow will be returned to investors, with a minimum 90% money-back guaran- tee. Commenting ahead of the pre-sale, Fiinu Founder and CEO Marko Sjoblom said: “This is an exciting opportuni- ty, not just for Fiinu and its investors, but for the wider banking industry. Upon launch, Fiinu has a number of exciting products and services which will help those who have been ignored by their banks for too long. This includes lending against an individual’s crypto-based assets, as well as the world’s first Bank Independent Overdraft. We have one simple aim, making your money work for you. Investors in our ICO will become part of Fiinu’s story that sees the power of technology used to tackle failures in the market and provide better banking services to all customers.” Fiinu's founders have worked together for nearly ten years and their successes include building and managing a UK-based FinTech company that has lent and recov- ered over 4.5 million overdraft-style loans with a trade value exceeding £1 billion. Under their management, at its height, the company would have been in the Top 10 of the Deloitte Technology Fast 500 fastest growing technology companies in the world with nearly 35,000% revenue growth over a five-year period. Fiinu's core team has gone through the full UK-bank license authorization process once before, for a well-es- tablished family office, and have built a digital banking platform from scratch. Combined, they have a wide range of dedicated skills, experience and understanding of what it takes to earn a UK-bank license. Founded by Marko Sjoblom, who previously led payday lending alternative Myjar, the firm is currently applying for a full UK banking license. As it gets ready to launch, it has brought onboard Andy Briscoe, chair of The Money Advice Service, the government-sponsored organisation dedicated to improving the financial resilience of the UK public, as chairman. In addition, Bank of England and Santander veteran David Hopton has been named a non-executive director. 18 FIINU NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 19. 2getherbank aims to become a global collaborative Marketplace Banking Platform based on Big Data, Artificial Intelligence, Machine Learning and Blockchain that allows users and companies, in a high security environment, to exchange any kind of real asset, manage programmatically and automatically their economy and access, in a marketplace, all financial products and services provided for Fitntech and Banks from around the world using an unique user interface. 2gether is using the latest technologies and promoting collaboration among users and innovators to build the most fair, global and competitive financial ecosystem in the world. No white paper is publicly but company says that ICO is coming soon. It will be public and will be launched along with the Private Beta. The company claims that they have been working in building a true operational banking service, built on Blockchain technology, for over 18 months and don’t want to launch a Token Sale without proof that they have a real working product and get some feedback from the community. Currently, only for the institutional and professional investors window is open. The company is founded and run by Salvador Casquero whose professional career was deeply related to fintech. Working for financial industry leaders from JPMorgan to banking entities such as BBVA, La Caixa and Banco Sabadell have been mixed with new technological skills acquired in tech companies such as Eresmás or Wana- doo and self-learning skills from his continuous explora- tion and testing of new technologies such as blockchain, artificial intelligence, predictive and matching algorithms, machine learning, internet of things, big data or natural language processing tools. As a result, Salvador has acquired sufficient qualification to launch 2getherbank a new project where it aims to comple- ment all the previous factors with the human one in order to achieve an ambitious and efficient distribution of resources, goods and services. 19 2GETHERBANK NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 20. Unfortunately, current crypto-friendly wallets cards and a new wave of ICO-placed neobanks are not able to solve the fundamental problem of rejection of the crypto ICO community by the traditional banking system. The main reasons are: They are hosted on very traditional banks, which is a time bomb. They are allowed to work within the framework until the volume of their business interferes with the core business of these players (which will happen sooner or later). While traditional banks are not ready to advocate for new players - they are ready to "allow them to exist" only until there are any risks on the horizon (which they will not be ready to bear). Some of them are going to obtain their banking license - but so far none have received it. Looking back on the experience of teams that develop such projects, then they had no previous experience in buying/selling banks and commu- nicating with regulators since they are represent- atives of the techno-blockchain community. There is no doubt that we need crypto-friendly banks. We need separate banks with their licenses that are not dependent on current players and are focused only on crypto-currencies and ICO-backed startups. The banks that will completely change and focus all business processes and technologies on this type of customers. The banks that are constantly communicat- ing with regulators of different countries: explaining what they do and how, how they work with clients, what types of risk appear and how it can be solved, develop- ing new technologies for this. In most jurisdictions, it’s easier to buy a bank than to obtain a new license as most regulators are determined to reduce the number of bank licenses in the market. Interestingly, all current projects are designed to receive licenses in Europe or the UK, i. e. to work with the euro or the pound as a currency, whereas according to statistics, most of the payments after the crypto conver- sion are converted into the US dollar at the first, second or third step. In addition, the American regulator constantly sets the "mood in the market" with its views on cryptocurrencies and ICO. Therefore, the question arises: why does one run away from the problem, instead of coming to its source? There are many small banks in the US – worth from $5 to $50 million – available for purchase. We believe that soon someone will decide to buy such a bank in the US, completely clear its balance from the current business (to avoid the conflict of interest), focus exclusively on the needs of blockchain / ICO world, and will change the team and business processes for such requirements. 20 The Bubble Generation on the way to the first Bubble Bank NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 21. For sure we need more than one such a bank, we need them in different jurisdictions, not only in the US as soon as the customers are located in different countries that have different regulation, which each time is optimal only for solving a number of issues of a certain range of clients; have their own currencies (and custom- ers want and should freely operate all major currencies). The bank’s business should be cleared from all non-core businesses and focused only on the blockchaincryp- toICO with all technologies, processes, business logic focused exclusively on a new class of assets and customers. We should also build an open dialogue with the regulator instead of playing dumb and talking about traditional business in meetings while making innova- tions under the table. We should declare that we do this and nothing else, we understand this, we are fully responsible for everything that we do and with whom we do it, we are in a constant dialogue/educating you, we disclose everything in detail and when we see something incomprehensible or a failure - we search how we can solve it at the level of technologies and processes. Most likely, the operations of such a bank/banks will be sabotaged by SWIFT - the main interbank transfer system (which always defends the interests of the largest correspondent banks and the dominance of the US currency) – therefore, these banks are likely to be linked to some new system of interbank transfers. For example, Ripple. So far, there is no way to avoid restric- tions imposed by geographic boundaries and there is no jurisdiction optimal for the whole world. One can start with two or three major jurisdictions (US - for the dollar, a European country - for the euro, Britain - for the pound), make a network, and then connect new players as partners. It is necessary to understand beforehand that this is not a struggle for one and only universal bank in the world (and you will never become one), but simply for the first practical full-fledged example/standard (not monopoly) to which people/banks will connect. Currently everyone understands that this kind of bank should have an open-architecture - a set of open APIs integrated into its own BaaS-platform. It will allow to: quickly launch products and partner with third-party developers for the customers’ sake; effectively integrate in one network your banks and any other banks (both traditional and neobanks that have raised or are raising ICO rounds in order to get their own banking license in their own countries), which want to join the community of crypto-friendly banks; to land any other fintech, blockchain, crypto-startups: to create, in fact, the first fintech-bank in the world allowing them to launch faster and cheaper as well as to scale to other countries. There is no need to reinvent all fintech services once again – too many people have been doing this for the past five year! You simply need to help them to move to new rails, integrate them among themselves on the basis of your open architecture and business processes tailored for a new type of customers; one of the key APIs should be blockchain-based digital KYC. It allows very fast complete legal verification (of both individuals and businesses) for any financial service performed online from any country. There will be no need to register and verify again in all other partner services. For partner startups it will reduce time and costs for development of their registration and compli- ance processes. In the future, based on these digital passports, as you accumulate data about your behavior in other services (only if you want to share this data! and only with those you choose!), you will receive your online score, which will make it easier for you to get loans from existing lending fintech startups and emerging blockchain startups; why are these 8 banks going to obtain 8 licenses in two countries? Seven licenses in eight coun- tries – cool, but licenses + backends won’t give you a competitive advantage. You can rent them to other players. It’s important and difficult to do it for the first time. But it’s silly to do it for 3,4,5,10 times. People need new services, not new licenses. 21 The Bubble Generation on the way to the first Bubble Bank NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 22. As mentioned before, a big shortcoming of existing projects (not yet launched but planning the launch): is their focus on retail customers instead of small and medium business. Whereas there about 500 customers (which have raised over $3 billion through ICO) on the market. This type of customers is very homogeneous, fast-growing, and absolutely no one is ready to serve them now. In the second approximation, there are other very clear clients with similar problems: crypto-exchang- es, exchangers, wallets, money transfer services, etc. The "Blue Ocean" are, of course, the representatives of the GIG-economy: freelancers, independent contrac- tors, makers and doers. They should work with SMEs first (and not second or third) as they are the driver of the new economy. While retailers - their employees, partners and customers - will come after them. Clayton M. Christensen, who coined the term ‘disruptive innovations’, in The Innovator's Dilemma analyzes how large and successful corporations continue to be successful and innovative (this is the "innovator's dilemma" - the lack of motivation to disrupt yourself if you are already big and successful) and concludes that the only way is to completely separate your new business from the old one. The new business should have its own goals and objectives (not overlapping with the old business), its people and corporate culture, even its own separate buildings and uniform. The same story is with blockchain, cryptocurrencies and ICO - trying to shove them into the old framework, processes, approaches and regulation, you stumble upon the fact that they are rejected and do not take root, they die and damage the "old body". It is only possible to give life to a new economy by giving it a certain degree of freedom (the opportunity to take risks, try, make mistakes and not be punished - the fear of making mistakes destroys any innovations: this is a long-proven axiom). We must admit that the old rules and regulations do not work if we really want to grow something new and useful for society. While the new ones are non-existent, they just have to be created. Therefore, the regulator should regulate with caution: not as a judge, but as a mentor. Regulators are able to kill anything, but no regulator is able to create something - this is the destiny of entrepreneurs. Given that rules are only being formed, players should not be punished for what was committed before their introduc- tion. You shouldn’t regulate too harshly what has not yet appeared and formed - you can only kill it this way. We are for the fact that if regulation comes into conflict with logic, progress and benefit for clients - such regulation should be changed. Rules are not the Bible, they were invented looking up the past (instead of the future). They are created to help achieve some goal, and if the goal is changing, then the rules should change! If something is not clear, it does not mean that it is something bad. This is something that challenges us to study it, to help it grow. 22 The Bubble Generation on the way to the first Bubble Bank NEW ICO-BACKED CRYPTO-FRIENDLY NEOBANKS VS «CLASSIC» FINTECH NEOBANKS: REINVENTING THE WHEEL

- 23. The new report by Life.SREDA https://goo.gl/ztyovn A lot of hype, but almost nothing inside OVERVIEW OF CRYPTO- FRIENDLY CARDS

- 24. G G K from Money Of The Future 2H'2016 fintech&blockchain report