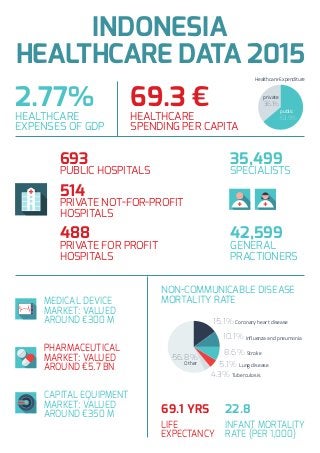

Indonesia Healthcare data - 2015

Economic Outlook: GDP annual growth was close to 6 percent since 2009, came down to 5,2 percent in the beginning of 2014 and is expected to remain just below 5 percent in the coming years. Indonesia deployed a 2005-25 Master Plan for the “Acceleration and Expansion of Indonesia’s Economic Development”. 2015 is the start of the 3rd phase. GDP per capita is around € 1.400, which is half of the China figure or one third of Brazil. Public debt is close to 26 percent of the GDP, coming down from over 65 percent in 2000, but expected to rise to 35 percent in the next 3 years. The Healthcare System: In 2014, Indonesian healthcare expenditures represented only 3,4 percent of its GDP. Compared to China (5,9 percent) and Egypt (5,2 percent) Indonesia scores low, as even India is at 3,7 percent. 40 percent comes from public sources, 10 percent is funded by private insurance companies and employers, 5 percent by charities and NGO’s and 45 percent is financed by patient co-payments. Outbound Medical tourism is substantial. Those who can afford it, travel to (mostly) Singapore and Malaysia to get medical treatment. The amount of healthcare spending outside the country amounted to € 10 m in 2014, which is half of the total (public and private) healthcare expenditures in Indonesia. Reforms: Reforms will address the following challenges Lack of accessibility of medical services Quality of care in public facilities There is a poorly functioning referral system, poor quality services at primary and referral levels, and high treatment costs Patient safety: this is also a general concern, as only 2 out of 3 hospitals are (nationally) accredited Lack of investment in healthcare Recently a universal health insurance program has been deployed. The Markets: Factors like government reforms in the healthcare system, changes in the demographic profile and increased incidence of chronic conditions, such as diabetes and cardiovascular disease are all expected to contribute to the growth of the Indonesian healthcare system. Overall the Indonesian healthcare market accounted for around € 20 bln in 2014. Although annual growth is uneven from year to year, TforG forecasts an average yearly growth of 13 to 16 percent in the coming 3 years. 51 percent of the medical expenses are used in the private sector. http://www.tforg.com/bi-store/store/national-landscape-healthcare-outline-indonesia-report/

Recomendados

Recomendados

Mais conteúdo relacionado

Destaque

Destaque (16)

Indonesia Healthcare data - 2015

- 1. 2.77% HEALTHCARE EXPENSES OF GDP 69.3 € HEALTHCARE SPENDING PER CAPITA 693 PUBLIC HOSPITALS 514 PRIVATE NOT-FOR-PROFIT HOSPITALS 35,499 SPECIALISTS 42,599 GENERAL PRACTIONERS 69.1 YRS LIFE EXPECTANCY 22.8 INFANT MORTALITY RATE (PER 1,000) 488 PRIVATE FOR PROFIT HOSPITALS MEDICAL DEVICE MARKET: VALUED AROUND €300 M PHARMACEUTICAL MARKET: VALUED AROUND €5.7 BN CAPITAL EQUIPMENT MARKET: VALUED AROUND €350 M 15.1% 56.8% 5.1% 10.1% 4.3% 8.6% Tuberculosis Lung disease Stroke Other Influenza and pneumonia Coronary heart disease NON-COMMUNICABLE DISEASE MORTALITY RATE 63.9% 36.1% private Healthcare Expenditure public INDONESIA HEALTHCARE DATA 2015