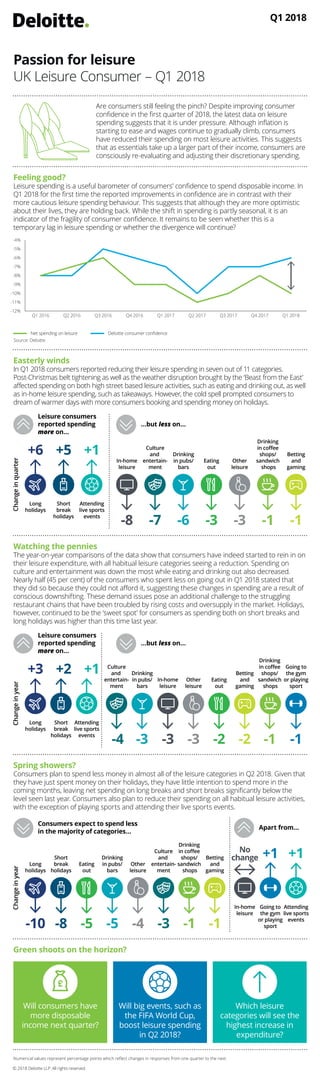

Passion for leisure: UK Leisure Consumer – Q1 2018

- 1. Will consumers have more disposable income next quarter? Will big events, such as the FIFA World Cup, boost leisure spending in Q2 2018? Which leisure categories will see the highest increase in expenditure? Green shoots on the horizon? © 2018 Deloitte LLP. All rights reserved. Numerical values represent percentage points which reflect changes in responses from one quarter to the next. -3 In-home leisure -4 Culture and entertain- ment -3 Drinking in pubs/ bars -2 Eating out -1 Drinking in coffee shops/ sandwich shops +2 Short break holidays +3 Long holidays +1 Attending live sports events -3 Other leisure -2 Betting and gaming Leisure consumers reported spending more on… Changeinyear …but less on… -1 Going to the gym or playing sport Watching the pennies The year-on-year comparisons of the data show that consumers have indeed started to rein in on their leisure expenditure, with all habitual leisure categories seeing a reduction. Spending on culture and entertainment was down the most while eating and drinking out also decreased. Nearly half (45 per cent) of the consumers who spent less on going out in Q1 2018 stated that they did so because they could not afford it, suggesting these changes in spending are a result of conscious downshifting. These demand issues pose an additional challenge to the struggling restaurant chains that have been troubled by rising costs and oversupply in the market. Holidays, however, continued to be the ‘sweet spot’ for consumers as spending both on short breaks and long holidays was higher than this time last year. No change In-home leisure -3 Culture and entertain- ment -5 Drinking in pubs/ bars -5 Eating out -1 Drinking in coffee shops/ sandwich shops -8 Short break holidays -10 Long holidays +1 Attending live sports events -4 Other leisure -1 Betting and gaming Consumers expect to spend less in the majority of categories… Changeinyear Apart from... +1 Going to the gym or playing sport Spring showers? Consumers plan to spend less money in almost all of the leisure categories in Q2 2018. Given that they have just spent money on their holidays, they have little intention to spend more in the coming months, leaving net spending on long breaks and short breaks significantly below the level seen last year. Consumers also plan to reduce their spending on all habitual leisure activities, with the exception of playing sports and attending their live sports events. -8 In-home leisure -7 Culture and entertain- ment -6 Drinking in pubs/ bars -3 Eating out -1 Drinking in coffee shops/ sandwich shops +5 Short break holidays +6 Long holidays +1 Attending live sports events -3 Other leisure -1 Betting and gaming Leisure consumers reported spending more on… Changeinquarter …but less on… Easterly winds In Q1 2018 consumers reported reducing their leisure spending in seven out of 11 categories. Post-Christmas belt tightening as well as the weather disruption brought by the ‘Beast from the East’ affected spending on both high street based leisure activities, such as eating and drinking out, as well as in-home leisure spending, such as takeaways. However, the cold spell prompted consumers to dream of warmer days with more consumers booking and spending money on holidays. Source: Deloitte -12% -11% -10% -9% -8% -7% -6% -5% -4% Deloitte consumer confidenceNet spending on leisure Q1 2018Q4 2017Q3 2017Q2 2017Q1 2017Q4 2016Q3 2016Q2 2016Q1 2016 Feeling good? Leisure spending is a useful barometer of consumers’ confidence to spend disposable income. In Q1 2018 for the first time the reported improvements in confidence are in contrast with their more cautious leisure spending behaviour. This suggests that although they are more optimistic about their lives, they are holding back. While the shift in spending is partly seasonal, it is an indicator of the fragility of consumer confidence. It remains to be seen whether this is a temporary lag in leisure spending or whether the divergence will continue? Are consumers still feeling the pinch? Despite improving consumer confidence in the first quarter of 2018, the latest data on leisure spending suggests that it is under pressure. Although inflation is starting to ease and wages continue to gradually climb, consumers have reduced their spending on most leisure activities. This suggests that as essentials take up a larger part of their income, consumers are consciously re-evaluating and adjusting their discretionary spending. Passion for leisure UK Leisure Consumer – Q1 2018 Q1 2018