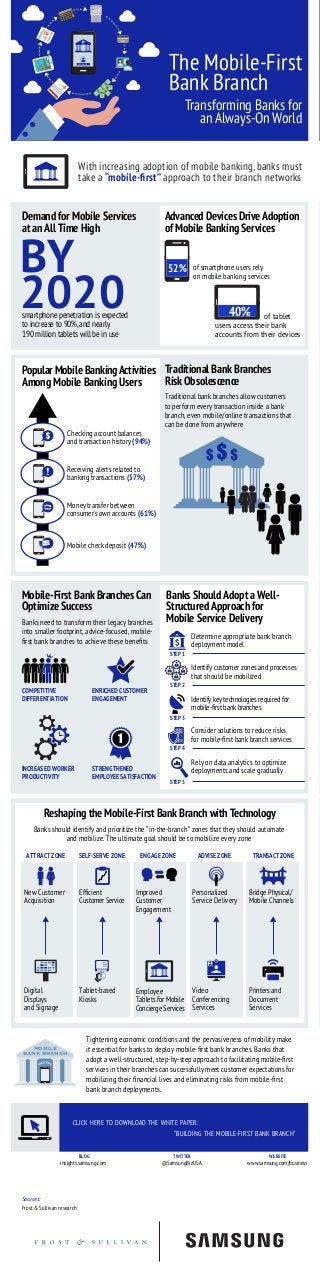

The Mobile-first Bank Branch

- 1. The Mobile-First Bank Branch Transforming Banks for an Always-On World With increasing adoption of mobile banking, banks must take a “mobile-first” approach to their branch networks Demand for Mobile Services at an All Time High BY 2020 of tablet users access their bank accounts from their devices 52% of smartphone users rely on mobile banking services 40%smartphone penetration is expected to increase to 90%,and nearly 190 million tablets will be in use Popular Mobile Banking Activities Among Mobile Banking Users Checking account balances and transaction history (94%) Receiving alerts related to banking transactions (57%) Money transfer between consumer’s own accounts (61%) Mobile check deposit (47%) Traditional Bank Branches Risk Obsolescence Mobile-First Bank Branches Can Optimize Success Banks need to transform their legacy branches into smaller footprint, advice-focused, mobile- first bank branches to achieve these benefits Traditional bank branches allow customers to perform every transaction inside a bank branch, even mobile/online transactions that can be done from anywhere STRENGTHENED EMPLOYEE SATISFACTION COMPETITIVE DIFFERENTIATION ENRICHED CUSTOMER ENGAGEMENT INCREASED WORKER PRODUCTIVITY Banks Should Adopt a Well- Structured Approach for Mobile Service Delivery Reshaping the Mobile-First Bank Branch with Technology Determine appropriate bank branch deployment model Banks should identify and prioritize the “in-the-branch” zones that they should automate and mobilize. The ultimate goal should be to mobilize every zone ATTRACT ZONE SELF-SERVE ZONE ENGAGE ZONE ADVISE ZONE TRANSACT ZONE Identify customer zones and processes that should be mobilized Identify key technologies required for mobile-first bank branches Consider solutions to reduce risks for mobile-first bank branch services Rely on data analytics to optimize deployments and scale gradually Digital Displays and Signage New Customer Acquisition Tablet-based Kiosks Efficient Customer Service Employee Tablets for Mobile Concierge Services Improved Customer Engagement Video Conferencing Services Personalized Service Delivery Printers and Document Services Bridge Physical/ Mobile Channels Tightening economic conditions and the pervasiveness of mobility make it essential for banks to deploy mobile-first bank branches. Banks that adopt a well-structured, step-by-step approach to facilitating mobile-first services in their branches can successfully meet customer expectations for mobilizing their financial lives and eliminating risks from mobile-first bank branch deployments. CLICK HERE TO DOWNLOAD THE WHITE PAPER: “BUILDING THE MOBILE-FIRST BANK BRANCH” Sources: Frost & Sullivan research Advanced Devices Drive Adoption of Mobile Banking Services STEP 1 STEP 2 STEP 3 STEP 4 STEP 5 $ MOBILE BANK BRANCH BLOG TWITTER WEBSITE insights.samsung.com @SamsungBizUSA www.samsung.com/business