JLL Global300 - Top 30 Real Estate Markets

•

41 gostaram•10,329 visualizações

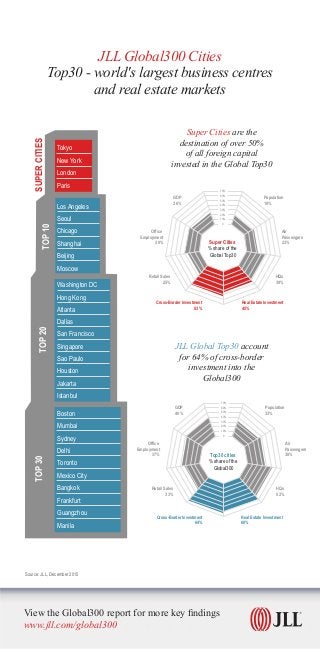

JLL’s Global300 is based on an Index of Commercial Attraction which measures a city’s economic and real estate power and status. Underpinned by a proprietary database of key performance indicators covering 660 cities worldwide, the Index is unique in that it includes key real estate measures (namely investment volumes and commercial real estate stock), as well as socio-economic and business indicators such as economic output, population, air connectivity and corporate presence. Top 30 Real Estate Markets account for 60% of real estate investment and 64% of cross-border investment globally. If you want to find out more about cities and real estate visit our website: www.jll.com/cities-research

Denunciar

Compartilhar

Denunciar

Compartilhar

Baixar para ler offline

Mais conteúdo relacionado

Destaque

Destaque (10)

How Story Tellers Make Real Estate Meetings Meaningful

How Story Tellers Make Real Estate Meetings Meaningful

Daily Activity Checklist from the book Less Blah Blah More Ah Ha.

Daily Activity Checklist from the book Less Blah Blah More Ah Ha.

Mais de JLL

Mais de JLL (20)

Último

Call Girls in Mahavir Nagar whatsaap call US +919953056974

Call Girls in Mahavir Nagar whatsaap call US +9199530569749953056974 Low Rate Call Girls In Saket, Delhi NCR

9953056974 Low Rate Call Girls In Saket, Delhi NCR

9953056974 Low Rate Call Girls In Saket, Delhi NCR9953056974 Low Rate Call Girls In Saket, Delhi NCR

Último (20)

Call Girls in Mahavir Nagar whatsaap call US +919953056974

Call Girls in Mahavir Nagar whatsaap call US +919953056974

9953056974 Low Rate Call Girls In Saket, Delhi NCR

9953056974 Low Rate Call Girls In Saket, Delhi NCR

Provident Solitaire Park Square Kanakapura Road, Bangalore E- Brochure.pdf

Provident Solitaire Park Square Kanakapura Road, Bangalore E- Brochure.pdf

Ryan Mahoney - How Property Technology Is Altering the Real Estate Market

Ryan Mahoney - How Property Technology Is Altering the Real Estate Market

Kumar Fireworks Hadapsar Link Road Pune Brochure.pdf

Kumar Fireworks Hadapsar Link Road Pune Brochure.pdf

LCAR Unit 22 - Leasing and Property Management - 14th Edition Revised.pptx

LCAR Unit 22 - Leasing and Property Management - 14th Edition Revised.pptx

How to Navigate the Eviction Process in Pennsylvania: A Landlord's Guide

How to Navigate the Eviction Process in Pennsylvania: A Landlord's Guide

A Brief History of Intangibles in Ad Valorem Taxation.pdf

A Brief History of Intangibles in Ad Valorem Taxation.pdf

Eco-Efficient Living: Redefining Sustainability through Leech's Green Design ...

Eco-Efficient Living: Redefining Sustainability through Leech's Green Design ...

Call Girls In Sahibabad Ghaziabad ❤️8860477959 Low Rate Escorts Service In 24...

Call Girls In Sahibabad Ghaziabad ❤️8860477959 Low Rate Escorts Service In 24...

Namrata 7 Plumeria Drive Pimpri Chinchwad Pune Brochure.pdf

Namrata 7 Plumeria Drive Pimpri Chinchwad Pune Brochure.pdf

Prestige Rainbow Waters Raidurgam, Gachibowli Hyderabad E- Brochure.pdf

Prestige Rainbow Waters Raidurgam, Gachibowli Hyderabad E- Brochure.pdf

Anandtara Iris Residences Mundhwa Pune Brochure.pdf

Anandtara Iris Residences Mundhwa Pune Brochure.pdf

Everything you ever Wanted to Know about Florida Property Tax Exemptions.pdf

Everything you ever Wanted to Know about Florida Property Tax Exemptions.pdf

JLL Global300 - Top 30 Real Estate Markets

- 1. TOP10 SUPERCITIES Los Angeles Seoul Chicago Shanghai Beijing Moscow Washington DC Hong Kong Atlanta Dallas San Francisco Singapore Sao Paulo Houston Jakarta Istanbul Boston Mumbai Sydney Delhi Toronto Tokyo New York London Paris Mexico City Bangkok Frankfurt Guangzhou Manila TOP20TOP30 Population 33% Air Passengers 38% HQs 52% Real Estate Investment 60% Cross-Border Investment 64% Retail Sales 33% Office Employment 37% GDP 40% 70% 60% 50% 40% 30% 20% 10% 0 Top30 cities % share of the Global300 Population 19% Air Passengers 23% HQs 39% Real Estate Investment 45% Cross-Border Investment 53% Retail Sales 25% Office Employment 30% GDP 26% 70% 60% 50% 40% 30% 20% 10% 0 Super Cities % share of the Global Top30 Super Cities are the destination of over 50% of all foreign capital invested in the Global Top30 JLL Global Top30 account for 64% of cross-border investment into the Global300 JLL Global300 Cities Top30 - world's largest business centres and real estate markets Source: JLL, December 2015 View the Global300 report for more key findings www.jll.com/global300