SOLAR potential EDIT 2

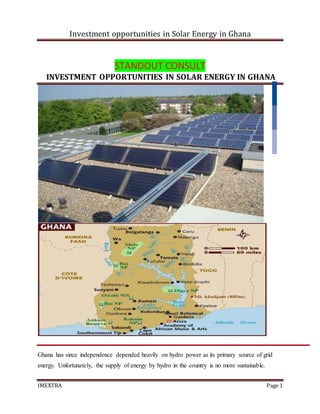

- 1. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 1 STANDOUT CONSULT INVESTMENT OPPORTUNITIES IN SOLAR ENERGY IN GHANA Ghana has since independence depended heavily on hydro power as its primary source of grid energy. Unfortunately, the supply of energy by hydro in the country is no more sustainable.

- 2. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 2 Energy is a major requirement for economic growth and development. Over the years, a number of thermal plants have been installed to append the supply from the hydro plants. There is a direct link between energy use, economic growth and standard of living. At the same time energy supply has serious financial and environmental implications to such an extent that uncontrolled energy consumption will have adverse consequences on the economy and the environment. At a time when the Ghanaian economy is achieving sustained growth in excess of 6 per cent annually, with ambitions to raise this further, there is a risk that misguided and inappropriate policies will lead to the power sector becoming a drag on the economy. A major, avoidable power crisis in 2006/2007 is estimated to have cost the country nearly 1 per cent in lost growth of gross domestic product during those years. Five years later, Ghana once again was plunged into power shortages, which also could have been avoided if lessons from the past had been learned and decisions taken to ensure that adequate dual-fuel generation capacity was built. The present recent power shortages, arising from a cut-off of imported gas from Nigeria, could have been mitigated if Ghana's own gas from the Jubilee field had been developed in a timely manner in parallel with oil production that began in 2010(World Bank's 2013 energy sector report). In most countries, energy sector investments are mostly carried out by governments. However, the Ghanaian energy sector rather possesses numerous opportunities for private investments with regard to the heavy shortfall in supply. Ghana relies on two primary types of generation facilities: hydroelectric plants and thermal. Presently, there are ten major generation facilities in Ghana, three hydroelectric and seven thermal. The recently commissioned Bui Hydro plant is expected to add 400MW when fully operational. Historically, Ghana has been largely dependent on hydroelectric power. OVERVIEW OF GHANA’S ENERGY SITUATION

- 3. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 3 Electricity access (September 2013) 80% Electricity installed capacity 2013 3,170mw Electricity generation 2013 12,200gwh Crude oil production (2013 av) 90,000b/day Energy resources: solar energy 4.5- 6.0kwh/m2/day Wind energy along coast 5.0m/s at 12 meters height Hydro 3,500mw (1580 exploited) Bui hydro power 400mw1 CURRENT ENERGY FORECAST (DEMAND AND SUPPLY) 1 Energy Commission Annual Statistics 2014

- 4. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 4 Ghana already started investing in renewable energy even if it is still in a slow process. Aside from the Bui, Kpong and Akosombo Dams in Ghana, the first Solar Power plant was introduced at Navrongo, in the Upper East Region of Ghana in May 2013. The Navrongo Solar Power Plant cost the Volta River Authority an estimated 8 Million US Dollar Budget. It is already reported that the plant is not working efficiently. Problems have occurred while storing energy and delivering energy to the households. Another big investment planned is the Pwalugu Multipurpose Hydropower Dam, in the Upper East region at the White River in Ghana. The construction of this project will start in 2017 and is planned to finish in 2022. The Pwalugu Dam is considered to function as a multipurpose dam for several purposes, such as for generating electricity as the major function, and for flood Control. The construction and operation of the dam will provide many job opportunities as Planned. It will however also affect the surrounding environment with traffic noise, dust and Exhaust emissions. Many people might feel threatened by that and have to relocate, for which the Volta River Authority plans on consulting the public and raise awareness of the project, its benefits and its effects. Renewable energy is one arguable topic on whether it could succeed in Ghana or not. Many Steps are however being taken and using renewable energy would mean the prices of electricity

- 5. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 5 And heat would decrease, since the energy comes from an infinite source. Electricity would not only become cheaper, but also more regularly provided than at the current state. It is in fact an expensive investment for the government and the investor companies, but with the financial Support coming from developed countries it is not farfetched, even solar street lights are being used in several areas in Ghana, and seen as a step forward to an eco-friendlier country. In order to promote and invest in renewable energy resources, and support our climate, several countries hence donate or support foreign governments in financing and training to take the step towards an eco-friendly environment. One major investor in Ghana is Germany. In the Previous year, Germany has boosted Ghana’s energy sector with 1.8 million Euro via the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) after the ratification of the Renewable Energy Act in 2011.The German-Ghanaian bonds grow stronger through the Frequent financial investment in biomass projects and climate change opportunities as well. It is important to mention that financial support and investment alone cannot aid the environment and help the Ghanaian climate if there are no awareness campaigns and projects. .2 2 Energy Commission strategic report 2014

- 6. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 6

- 7. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 7 CURRENT ELECTRICITY CHARGES IN GHANA Tariff category Tariff Residential : 0 – 50 exclusive GHp/kwh 51 – 300 GHp/ kwh 301 – 600 GHp/ kwh 601+ GHp/ kwh Service charge GHp / kwh 17.1998 34.5072 44.7836 49.7596 324.5190 Non – residential: 0 – 300 GHp/ kwh 301 – 600 GHp/ kwh 601+ GHp/ kwh SERVICE CHARGE 49.6081 52.7884 83.2932 540.8649 SLT- LV: Max demand Energy change Service charge 3028.8436 51.7067 2163.4597 SLT- MV Max demand Energy charge Service charge 2596.1516 40.0240 3,028.8436 SLT-HV Max demand Energy charge Service charge 2596.1516 36.7788 3,028.8436 SLT-HV MINES Max demand 3028.8436

- 8. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 8 Energy Service charge 58.4134 3028.84363 4 3 PURC ( public utility regulatory commission) 4 PURC ( Public Utility Regulatory Commission)

- 9. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 9

- 10. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 10

- 11. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 11 SOLAR INVESTMENT POTENTIAL ADVANTAGES AND DISADVANTAGES IN GHANA Advantages of solar investment in Ghana Disadvantages of solar investment in Ghana High patronage of power in Ghana High capital requirement Climate friendly High political procedures Profitable investment in the rural areas Bureaucratic procedures Resources are infinite Inadequate experts Public private partnership advantage by government High cost of maintenance High demand for power in Ghana Unreliable sources of power in Ghana

- 12. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 12 The potential drivers for electricity consumption Under contemporary circumstances, we project that the potential drivers for electricity consumption would be the same as in 2012 and are as follow: and influenced by gold production; Other or general Industrial share also growing; -going national electrification scheme; -stream and mid-stream ac

- 13. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 13 Demand Drivers Minimum Maximum VALCO One more Plotline Two more Potlines 600 GWh5 1,200 -1300 GWh Gold mining Surface mining Deep mining 200-232 GWh 400 -450 GWh Other Industries 320 350 National Electrification 172 GWh 375 GWh Natural GDP growth NationalAverage 2000-2012electricity growth 2010-2012electricity growth 121 GWh 978 GWh Gas processing construction 100 GWh 200 GWh Demand-side management -10 -23 Total 1,503-1,535 5 Energy commission

- 14. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 14 Generation system, accounting for 1,180 MW of generation capacity or 60 per cent of the national total. The thermal plants, two located at Takoradi and four located in Tema, and the Mines Reserve plant, represent the remaining 40 per cent of generation capacity. The Takoradi plants, one

- 15. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 15 simple cycle combustion turbine plant and one more efficient combined cycle plant, provide a total maximum capacity rating of 550 MW. These plants can be operated on light crude oil (LCO) or natural gas (NG); at present they are run mostly on LCO due to challenges vis-à-vis natural gas availability. The remaining three plants are one LCO/NG dual-fired plant and two diesel generators located in Tema, which together provide an additional 213 MW of capacity. Currently power supply from Sunon Asogli Plant is not available due to lack of gas supply as a result damage to the West Africa Gas Pipeline (WAGP). The total electricity generated in 2012 was 12,024GWh; as against 11,200GWh in 2011. The 2012 generation comprised 8,071GWh (67.1 %) hydropower and 3,953GWh (32.9%) of thermal power. Even though hydropower generation share decreased by about 0.4 percentage points over 2011, total energy produced increased by about 824GWh. This increase was due to significant water inflows into the Akosombo reservoir in the year 2012. Currently, Ghana as a nation has exhausted her major hydroelectric power. To meet the increasing power demand and making up for the heavy shortfall, non-hydro power options will seriously be considered by government. Before the power sector reform, Ghana’s market was highly regulated, with generation and transmission vertically integrated in VRA and distribution handled by ECG, a fully state owned enterprise, and NED, a subsidiary of VRA. ECG delivered power to customers in the southern half of the country while NED delivered power to customers in the northern half. Like many developing nations, Ghana needed outside capital to help develop its power sector. As part of the power sector reforms, Ghana commenced the process of unbundling generation, transmission, and distribution functions into separate markets, with immediate competition in generation and eventually distribution. As a result of reform, utilities have become specialized entities focusing on one of three areas. VRA maintained its generation assets including Akosombo, Kpong and Aboadze, and now focuses almost exclusively on generation. ECG and NED continued to focus exclusively on distribution. As a new public utility, GRIDCo was essentially spun out of VRA and has the sole responsibility for operating transmission in an open and non-discriminatory manner. The PURC and EC were purposefully formed to jointly oversee the electricity sector. The PURC sets rates and tariffs, monitors performance, promotes fair competition, and works to balance the interests

- 16. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 16 of utility providers and consumers. The EC issues licenses and establishes performance standards for utilities. The new structure enables and encourages the free entry of independent power producers (IPPs) into the generation market, creating a competitive generation market which, when combined with open access to transmission, also facilitates a bulk power trading market. The structure also emphasizes decentralization at the distribution level, with plans for eventually adding more distributors, each operating in a defined geographic service area. While the reform process has formally been completed, the power sector is still undergoing transition in terms of achieving the designed structure. At present VRA accounts for about 85 per cent of all grid-connected generation, with only the remaining 15 per cent of generation coming from other producers.

- 17. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 17

- 18. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 18 THE ENERGY SUPPLY ORGANOGRAM IN GHANA POWER CONSUMPTION Currently, Ghana’s electricity sector has a customer base of about 4 million residential and commercial customers and 4,153 industrial customers. In 2013 these customers contributed to a peak power demand of 1,729 MW which indicates a 4 percentage rise over the previous year. Peak demand is the maximum amount of electricity that customers consume instantaneously. Until 1998, the supply of electricity in Ghana was exclusively from hydroelectric sources. Since then about 1,000 MW of thermal generation capacity has been added. Currently, the installed nameplate generation capacity is 2,412 MW. The current dependable generation capacity of 2,125 MW in Ghana is made up of about 50 per cent hydro and 50 per cent thermal. World Bank, 2013, Energizing Economic Growth in Ghana: Making the Power and Petroleum

- 19. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 19 Ghana, with its attractive emerging economy, is seeking for more Independent Power Producers (IPPs) to boost up national electricity production. There is potential for electricity generation from renewable energy sources such as solar, wind, biomass and small hydro to connect communities that are currently off-grid. In the renewable energy bill currently before parliament, the country aims to supply 10 per cent of its domestic demand through modern renewable technologies by 2020. The key challenges facing the energy sector are the following: Rapidly growing demand for energy by all sectors due to the expanding economy and growing population. Risk of significant imbalance between energy production and indigenous sources of supply. Inadequate investments to match the growing energy demand due to lack of capital. Risk of over reliance on imports to meet local shortfalls of conventional fuels, which could threaten the country’s supply security, making it vulnerable to external pressures. High levels of end-use inefficiency culminating in waste of final energy forms. Inefficient pricing of energy services resulting in poor financial positions of the energy providers, but also high cost of tariff, which would not encourage maximum use of energy for wealth creation and could threaten the country’s growth in prosperity and modern way of life. Operational inefficiencies of the utilities leading to high energy losses and consequently increasing cost of supply and distribution. Solar energy, which is relatively abundant, is barely exploited to supplement the commercial energy requirements of the country.

- 20. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 20 This document presents some historical energy use patterns in Ghana and how the future energy scenery would look like for the period 2006 – 2020. The energy projections were based on GPRS projected economic growth rates. Possible interventions in the energy supply-demand chain, i.e.

- 21. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 21 from energy production and transportation to the demand sectors of the economy have been discussed in the annexes to this main text. Strategic targets and plans and recommended policies for the energy sector have been provided. Sectoral strategic targets and plans are also available in the annexes. The primary indigenous energy comprised 90-95 percent wood fuels (generally called biomass), 5-10 percent hydro energy and less than one percent solar energy. The hydro energy was supplied from Akosombo and Kpong hydroelectric dams in the form of electricity. Solar energy was used for the sun-drying of crops; mainly cocoa; cereals consisting of maize, paddy rice, sorghum and millet; vegetables consisting of groundnuts and pepper and other exportable commodities requiring drying. Solar energy for production of electricity was relatively negligible; about 150 tons of oil equivalent. Government Energy Objective Five 2015 Accelerate the development and utilization of renewable energy and energy efficiency technologies so as to achieve 10 percent penetration of national electricity and petroleum demand mix respectively by 2020. Strategies Government recognizes the advantages of indigenous and renewable energy resources to complement the existing conventional and traditional energy mix of the country. The nation therefore target 10 percent of renewable in the electricity supply mix in terms of installed capacity and 10 percent of renewable in terms of petroleum fuel supplies by 2020. The renewable energy for electricity is expected to come mainly from solar, small and medium sized hydro plants, wind, biomass and municipal solid wastes.

- 22. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 22 Renewable energy to supplement petroleum supplies is expected to come from bio-fuels. Government Energy Objective Six • Enhance private sector participation in energy infrastructure development and service delivery. Strategies Private sector investment is a critical ingredient in the development of all aspects of the energy sector. In this regard the Government is; Pursuing the requisite legal and regulatory reforms and mechanisms to facilitate the participation of Independent Power Producers in electricity delivery .Establishing ‘Access Code’ that will guarantee open access to electricity transmission infrastructure. This could be done either as public-private partnership project or a wholly private sector investment. Facilitating the expansion of electricity supply capacity in the sub-region under the West African Power Pool (WAPP) protocol. Ghana’s total energy supply has to grow significantly to help achieve the development agenda goal. The challenge is how to increase the energy supply and also expand the energy infrastructure in the country in a way that is sustainable The Energy Resources and Vision Ghana is well endowed with a variety of energy resources including biomass, hydrocarbons, hydropower, solar and wind. It has the capacity to produce modern bio-fuels and is exploring options to develop nuclear energy. The energy sector vision is to develop an “Energy Economy” to secure a reliable supply of high quality energy services for all sectors of the Ghanaian economy and also to become a major export. The goals of the power sub-sector are to increase installed power generation capacity quickly from about 2,000 MW today to 5,000 megawatts (MW) by 2015, and increase electricity access from the current level of 66% to universal access by 2020. The challenge is how to attract investments to build the necessary infrastructure for the generation, transmission and distribution of electricity throughout the country. This is key to ensuring the sustainable development of the sector. Apart from financing, the policy focuses on institutional and human resource capacity strengthening as well as regulatory reforms required creating a competitive electricity market.

- 23. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 23 Creating the right environment for private-public partnerships in the development of new power plants is essential to the growth of the power sector. The biggest obstacle to achieving this is the issue of cost-recovery, a challenge that this policy tries to directly address. QUALIFICATION AND APPLICATION FOR LICENCE Any investor venturing into the RE( Renewable Energy) industry must be registered under Ghanaian law either as a limited liability company under the Companies Act, 1963 (Act 179) or under the Incorporated Private Partnerships Act, 1962 (Act 152). In addition to the incorporation requirement, investors must take note of the Ghana Investment Promotion Centre Act, 1994 (478) (the “GIPC Act”) and the Ghana Free Zone Act, 1995 (Act 504) (the “Free zone Act”). The GIPC Act provides the framework under which companies having foreign participation may register to obtain specified benefits: Unconditional transferability through any authorized dealer bank in freely convertible currency of: o Dividends or net profits attributable to the investment o Payments in respect of loan servicing where a foreign loan has been obtained o Fees and charges in respect of any technology transfer agreement registered under the GIPC Act o The remittance of proceeds (net of all taxes and other obligations) in the event of sale or liquidation of the enterprise or any interest attributable to the investment Guarantee against expropriation. Expropriation can only be done in the public interest or for a public purpose. The law requires that the expropriation must only be made upon the payment of fair and adequate compensation (which is subject to judicial review as to the adequacy of the compensation paid). The compensation must be paid without undue delay and authorization for its repatriation in convertible currency shall be issued Companies have the benefit of being able to have their disputes settled by International arbitration. More importantly, where there is disagreement between the investor and the

- 24. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 24 GoG as to the method of dispute settlement to be adopted, the choice of the investor shall prevail The GIPC provides assistance and guidance to companies and acts as liaison between the company and relevant GoG departments, agencies and any other public authorities Expatriate employees engaged in a company to which the GIPC Act applies, are entitled to utilize banking facilities through authorized dealer banks for the purpose of making remittances abroad where the remittances do not exceed the total official wage of the expatriate personnel Subject to application to the GIPC, exemption of import duties, sales tax or excise duties are available on the plant, machinery, equipment or parts thereof where the plant, machinery, equipment or parts of the plant machinery or equipment are not zero-rated under the Customs Harmonized Commodity and Tariff Code scheduled to the Customs, Excise and Preventive Service Act, 1993. Similarly, the Free Zone Act sets the legal regime for the establishment of free zones for the promotion of economic development and related matters. To operate in a free zone or to produce power geared towards power customers outside of Ghana the investor must register under the Free Zone Act. In view of the mechanisms operational under the West African Power Pool (WAPP), export of power may be a viable option for potential investors. The Free Zone Act provides, among other things, the following benefits: Exemption from the payment of income tax on profits for the first ten years from the date of commencement of operations and taxable at a rate not exceeding 8% after the tenth (10th) year An investor may hold 100% shares in a free zone enterprise An investor in a free zone shall be guaranteed unconditional transfer through an authorized dealer bank in free convertible currency of o Dividends or net profits attributable to the investment o Payments in respect of loans servicing where a foreign loan has been obtained o Fees and charges in respect of a technology transfer agreement

- 25. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 25 o The remittance of proceeds net of the taxes and any other obligations, in the event of the sale or liquidation of the enterprise or an interest attributable to the investment Guarantee against expropriation and in the event of any such expropriation, the Act makes provision for the payment of adequate compensation Entities seeking to engage in any commercial activity designated under the Act require a license from the Commission. For the purposes of the Act, commercial activity encompasses production, transportation, storage, distribution, sale and marketing, importation, exportation and re- exportation and installation and maintenance. According to the Licensing Manual for Service Providers in the Renewable Energy Industry, published in September, 2012 (the “RE Manual”) and issued by the Commission, entities that engage in different commercial activities require different licenses for each activity. All applications for licenses will receive notification of grant within sixty (60) days unless refused. Refusals may only be based on grounds of inadequacy of technical data, issues of national security, public safety, food security, health and environmental safety. The wholesale electricity supply license is granted for twenty (20) years and licenses once acquired are only transferable with the written approval of the Commission. According to the Licensing Manual for Service Providers in the Renewable Energy Industry, published in September, 2012 (the “RE Manual”) and issued by the Commission, entities that engage in different commercial activities require different licenses for each activity. All applications for licenses will receive notification of grant within 60 days unless refused. Refusals may only be based on grounds of inadequacy of technical data, issues of national security, public safety, food security, health and environmental safety. The wholesale electricity supply license is granted for 20 years and licenses once acquired are only transferable with the written approval of the Commission. For the purposes of acquiring the wholesale electricity supply license, the acquisition process is divided into three broad stages. These stages illustrate the kinds of information that will be required by the EC in order to grant approval for

- 26. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 26 progression to subsequent stages. The stages are as follows: Stage 1. Acquisition of provisional license, Stage 2. Prior to construction, Stage 3. Acquisition of operating license. It is important for RE developers to initiate their projects far in advance. Bureaucratic bottlenecks may hamper attempts to sail through the entire process; it is advisable for developers to involve the Ministry of Energy & Petroleum (MoEP) early on in the process to facilitate meetings with the various stakeholders in the energy sector. This method has been put to effective use in other projects in the energy sector. Qualification for a Licence 4.1 A license may only be granted to: (a) a citizen of Ghana; or (b) a body corporate registered under the Companies Code, 1963 (Act 179) or under any other law of Ghana; or (c) a partnership registered under the Incorporated Private Partnership Act, 1962 (Act 152). Application 4.2 An application for a license shall be made in writing addressed to the Executive Secretary of the Energy Commission and shall be submitted together with all relevant information as specified in the respective chapter for each license type. 4.3 An application for a license shall be made on forms approved and supplied by the Commission. The application form can also be accessed from the Commission’s website www.energycom.gov.gh. A sample of the form is provided as Schedule 1: “Application Form” of the Manual. 4.4 The applicant shall complete the appropriate application form in its entirety and submit all required attachments, affidavits, and evidence of capability specified by the form at the time an application is filed. 4.5 An incomplete application will not be processed or may be rejected. All specified exhibits required under Part A of the filing instructions shall be submitted together with the formal duly signed application form for consideration for the issue of a license to undertake the prescribed operations in the electricity supply industry in Ghana.

- 27. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 27 4.6 Separate applications are required from an applicant to engage in different market activities that fall within different segments of the industry. The Commission will accept a single application from an applicant in respect of multiple activities in the same segment of the industry. While the Commission will accept applications in this form, separate licenses will be issued for each market activity and for each facility where the activity is carried out and the appropriate fees charged. 4.7 An application shall be deemed to have been successfully lodged only if all relevant supporting documentation required as indicated in the respective chapter for each license type is attached in addition to full payment of the required application fee. 4.8 The Commission shall acknowledge receipt of an application for a license within 5 working days of submission of an application and indicate whether the applicant’s submissions fully satisfy the requirements expected for the relevant type of license. 4.9 An applicant may be required to furnish the Commission with additional information when necessary. Application Fee 4.10 The applicant shall pay to the Commission an application fee prescribed under LI ….. 4.11 The application fee to apply is stated in Schedule II: Schedule of Licence Fees. The application fees as stated in the Schedule shall be valid for the period from January 1 through to December 31 of each year. 4.12 Application fees may be revised. 4.13 Application fees are also payable for an application to transfer a license. 4.14 The stipulated application fee shall be payable in respect of each type of license sought, regardless of whether or not applications are made separately or are aggregated into a single application document. 4.15 A license application shall not be assessed unless the appropriate Application Fee is paid by the applicant.

- 28. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 28 4.16 Application fee paid at the time of submitting an application shall cover all the stages in the licensing process. 4.17 An amendment application filing fee shall be charged for a request to amend an approved license, sitting clearance, construction work permit or authorization to operate. 4.18 The amendment application filing fee shall be determined by the Commission based on the amount of work involved with the amended Obligation to be licensed 1.9 Section 8 of the Renewable Energy Act, 2011 (Act 832) provides that a person must not carry on operations in Ghana's Renewable Energy Industry for which a license is required unless the person either: (a) Holds a license granted under the Act authorizing the relevant operations; or (b) Is exempted from holding a license. 1.10 A breach of this requirement is an offence under the Renewable Energy Act, 2011 (Act 832) and may be sanctioned accordingly. Table 1: Duration of Licence Type of Licence Term of Licence Wholesale Electricity Supply Licence 20 years Biofuel Production Licence : Small, Medium & Large scales 20 years Bulk Biofuel Transportation Licence 5 years Bulk Biofuel Storage Licence 20 years Biofuel Export Licence 5 years Charcoal Production Licence 20 years Bulk Charcoal Transportation Licence 5 years Charcoal Wholesale/Storage Licence 5 years Charcoal Export Licence 1 year Briquettes/Pellet Production 20 years

- 29. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 29 Briquettes Export Licence 10 years Importation Licence 10 years Installation and Maintenance Licence 10 years 6 WHOLESALE ELECTRICITY SUPPLY LICENCE TO GENERATE ELECTRICITY FROM RENEWABLE ENERGY SOURCE Acquisition of Wholesale Electricity Supply Licence STAGE 1: ACQUISITION OF PROVISIONAL LICENCE Required Submissions Exhibit WS1- Scope of Operation Exhibit WS2- Company Registration Exhibit WS3- Principal Officers, Director and Partners Exhibit WS4- Ownership and Corporate Structure Exhibit WS5- Cross-ownership and Ring Fencing Exhibit WS6- Disclosure of Liabilities and Investigations Exhibit WS7- Financial Capability and Proposed Financial Plan Exhibit WS8- Statement of Assets Exhibit WS9- Feasibility Report Exhibit WS10- Business Plan Exhibit WS11 - Company History and Existing Activities Exhibit WS12- Industry Participation Exhibit WS13 - Operational Experience and Expertise Exhibit WS14 - Specific Licence Conditions and Exemptions 6 Ministry of energy licensemanual

- 30. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 30 Exhibit WS15 - Indicative Implementation Plan Exhibit WS16 - Commercially Sensitive Information Exhibit WS17 - Generating Plant Technology and Type of Renewable Energy Resource 7 CONCLUSION AND RECOMMENDATIONS For several decades, electricity generation, transmission and distribution in developing countries especially Ghana, have been monopolized by agencies mostly controlled and funded by governments. These agencies, for lack of adequate funding, have not been able to provide adequate and reliable services for most rural areas. Several developing countries have taken bold initiatives to restructure their electric power sector, with remarkable improvements in the availability and quality of electric power supply. The India experience through the Indian Renewable Energy Agency has shown that renewable energy resources and in particular, solar PV, have the potential to meet the electricity needs of developing countries in a deregulated electricity industry. Several constraints exists which hinder the dissemination of PV systems but these can be surmounted through policy, regulatory and financial provisions and the political will to achieve the millennium development goals, through the adoption of environmentally friendly technologies for electricity generation. In view of this, the government of Ghana is considering the alternative source of energy to beef up the existing inadequate one. The government of Ghana over the years have turn serious attention on the solar energy with serious participation of the private sector through the Public Private Partnership iniative (PPP). 7 World Bank Report 2013

- 31. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 31 Opportunities The political and economic stability of Ghana, as well as favorable environmental conditions afford a good basis for investment by Independent Power Producers (IPPs) to get into the Ghana RE market. Results from a study commissioned by the EC indicate that “… there exist wind regimes with speeds between the range of about 5.5m/s and 6.2m/s. An evaluation by experts from Risoe of the potential of the wind regime to generate electricity established a potential of about 300-500 MW. The average annual solar irradiation in different parts of the country ranges from 4.4 kWh/m2/day to 5.6 kWh/m2/day. This large solar potential can be harnessed for electricity and process heating purposes.”3 It is therefore no surprise that a number of IPPs are attracted to this area. A 155MW plant (being developed by Blue Energy, a UK based renewable energy investment company) and several other solar plants (over 100MW) are at various stages of development by IPPs. There are yet to be any major project developments in wind generation though.

- 32. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 32 CURRENT SOLAR DEVELOPMENT A 2MW solar plant has been installed in Navrongo, Upper East of Ghana. A 315kW solar plant has also been installed at Noguchi Memorial Research Institute at the University of Ghana, Accra. Licence Manual for the Service Providers in the Renewable Energy Industry has been developed. Companies have been granted provisional licenses for wholesale Renewable Energy electricity generation. The European Union has supported the Energy Commission to prepare a framework for resourcing and operationalisation of the Renewable Energy Fund. Draft Guidelines for net metering has been prepared. Standardized PPA is being developed. Guidelines for connecting RE plant to the distribution The government of Ghana over the years have been looking at the alternative sources of energy to curtail its persistent energy problem in the country, however much attention is turn to the solar energy which will be more efficient and serve as the alternative for the current shortage, but the main problem with this is the large capital needs in setting up the plant and its operations. The government of Ghana seeing the need and potentials solar can contribute to help augment the current energy needs is looking for private investors who have the means to set up the plant and its operation through its Public Private Partnership Initiative (PPP).8 The Government has established a target of 10% of power generation coming from renewable sources (which includes under-100 MW hydro plants) by 2020. So far, Ghana only has a 2MW grid-connected renewable energy plant in operation. Both solar and wind are at early stages of development, and the wind resource in Ghana is limited. 8 Ministry of energy strategic plan for 2014

- 33. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 33 Further, both solar and wind power are expected to require significant tariff premiums over Conventional generation to be financially viable. Thus, the target of 10% for 2020 is unlikely to be achieved. Nonetheless, global trends in the solar photovoltaic (PV) manufacturing industry, with sharply declining investment costs per kilowatt installed, suggest that medium- to large-scale grid- connected solar plants (without storage) have a role to play in Ghana. VRA could consider solar projects close to its reservoirs so that solar and hydropower could complement each other, and there would no additional costs of connecting the solar power to the grid. PURC’s announcement of the feed-in tariff for solar power has removed an element of uncertainty for potential private project developers. Further, it is also likely that stand-alone solar systems in the remotest rural areas are likely to be much cheaper than conventional rural electrification, whose subsidy requirements are a major burden for NED co and ECG. There are several opportunities in the solar energy production in Ghana but the key challenge is the capital requirement to set it up, any investor who is interested in the industry could take advantage of the PPP Policy Ghana government is offering.

- 34. Investment opportunities in Solar Energy in Ghana IMEXTRA Page 34 References: Aitken W. Donald (2003). Transitioning to a RenewableEnergyFuture. ISES (International Solar Energy Society) [online] [cited May 18, 2006]. Available: http://www.ises.org/shortcut.nsf/to/wp Cavusgil S. Tamer; Ghauri N. Perez & Agarwal R. Milind (2002). Doing business in emerging markets: entry and negotiation strategies. Sage Publication Inc. ISBN 0 – 7619 – 1374 – 2. CIA, (2008), World fact books, Ghana, available at: https://www.cia.gov/library/publications/the‐world‐factbook/geos/gh.html (accessed 29 October2008) Dovi, E. (2007). Africa’s major aluminumproducercloses amid Ghanaenergy crisis. [online] available at: www.voanews.com/english/archive/2007‐03/2007‐03‐16‐voa47.cfm (accessed 31 January, 2009). ESTIF, (2008). Solar thermal market in Europe: trends and market statistics 2007. European Solar Thermal Industry Federation, Renewable Energy House, Brussels. June 2008 Holm Dieter (2005). RenewableEnergyFuturefor the Developing World. ISES (International Solar Energy Society) [online] [cited May 18, 2006]. Available: http://www.ises.org/shortcut.nsf/to/wp99 IEA (2002). Renewableenergy, into the mainstream, The Novem Sittard, The Netherlands, 2002. Mensah‐Biney, R. (2007). Reflecting on the power/energy crisis in Ghana [online] available at: www.ghanaweb.com/GhanaHomePage/features/artikel.php?ID=127315 (accessed 31 January, 2009). New African (2007). Ghana:How the power shortage is being fought [online] available at: http://findarticles.com/p/articles/mi_qa5391/is_200710/ai_n21296867 Zittel, Werner (2002). RenewableEnergyin Europe – Pastand Future. First International Workshop on oil depletion. L‐B‐Systemtechnik GmbH, Germany. Uppsala, July 24, 2002